Caption. Image:

Subscriptions

Subscriptions: ownership model of the future or marketing stunt?

How do car subscriptions differ from existing rental or leasing and financing offerings, and what is their true market potential? Arthur D Little writes

The automotive and mobility market is in a state of flux. As new technologies give rise to innovative products and services, customer mobility demands are changing, forcing the industry to rethink its sales models and explore new concepts.

While the possession of a car remains important for many, service-oriented offerings are expected to hold significant growth potential. Moreover, the ongoing economic turmoil is increasing customers’ tendency to opt for risk-reduced, flexible usage models. Today’s car subscription schemes offer a high degree of flexibility and are getting introduced by automotive OEMs, rental companies, and disruptors.

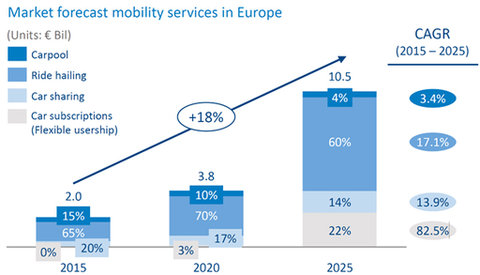

Subscription offerings are well-established in many industries – whether it is software, media streaming, or mobile phone contracts. In today’s automotive industry, however, this pricing model only represents a niche product within the mobility-as-a-service segment, with a market share of about 3%.

Ride hailing still accounts for the largest share, but subscription services are set to be the fastest-growing service over the next five years.

Credit:

Differentiating service or marketing stunt?

At first sight, subscription models appear highly attractive from the customer’s point of view. Especially in times of economic uncertainty and ever-changing mobility trends, these models match well with risk-averse customer groups that wish to remain flexible.

On closer examination, however, other traditional offerings (e.g. long-term rental or leasing) reveal similar features. So how do car subscriptions really differ from these offerings, or are they just a marketing stunt designed to appeal to a younger clientele?

While it is true that car subscription services overlap with other offerings in certain aspects, they do have their raison d’être. Three key differentiators illustrate how subscription schemes bridge the gap between long-term rental and leasing:

- Vehicle choice: A subscription model allows customers to choose a specific vehicle, as opposed to a rental model, which only allows for the selection of a vehicle category. In addition, the possibility to change the make or model of the car according to personal needs and preferences, while staying within the same contract and operator, further increases attractiveness.

- Contract flexibility: Subscriptions promise maximum flexibility. In contrast to leasing or long-term rentals, subscriptions eliminate the need for long-term contractual commitment and thus ownership rigidity.

- Convenience: Subscribers can simply select and book their preferred car online, while the provider takes care of the formalities. With an ‘all-in’ fee, subscribers neither have to go through detailed car configurations nor arrange the used car sale at the end of ownership.

Outlook

Car subscriptions bridge the gap between leasing and rental. They offer high flexibility and reduce risk, commitment and rigidity inherent in car ownership. This has proven particularly attractive in times of economic uncertainties and primarily targets a younger, up-and-coming clientele.

However, subscription models must be well marketed and positioned, as the increased flexibility leads to additional complex processes, demanding a higher price point than traditional leasing offers.

Multiple players with different backgrounds, from digital disruptors and rental companies to established multi-brand OEMs, are pushing into the market. While rental companies can realise considerable synergy potential with their existing business, OEMs may explore and pilot new online-focused direct sales models and third-party partnerships, especially for fulfilment processes.

The key is a business model that aligns with the company’s capabilities and positioning while addressing branding, service offerings, or lifecycle and asset management of the vehicles.

The business model must also ensure profitability by calibrating key levers, such as vehicle utilization, changeover, and car selection. Operationalisation challenges, which often originate within the company itself, require smart and pragmatic solutions.

Although car subscriptions currently represent only a niche among MaaS offerings, they have significant growth potential due to changing customer preferences. It is now time to make strategic decisions on how to shape this business.

Main image credit: