What is the best way to get from A to B?

Well, that depends on where you start from and where you would like to go. I would not take a taxi to get from London to Milan but equally, I would not take a plane to get from the Houses of Parliament to Buckingham Palace.

Scroll down or swipe up to read more

There are few industries that are witnessing as much disruption (and exciting changes) as the car supply and car finance industry. New technologies such as the smartphone, an increasing range of alternatively-fuelled cars, the promise of autonomous cars and the possibility of people-carrying drones are just some of the developments driving change. However, businesses need a reality check of the changes we might actually see during the next 5 to 10 years so that they can plan where and when to invest for those changes. Car manufacturers will no doubt already have invested a significant amount on tooling and production equipment to enable them to deliver new car models over that period, but businesses involved in distributing, financing and other areas of new and used car supply also need to plan for the coming changes.

The smartphone is here and has already changed how we order and pay for some types of journeys, such as ride hailing. The number of alternatively-fuelled cars on our roads today is growing but the numbers are still very modest compared to the number of cars sold with combustion engines. In 2017, there were 120,000 hybrid, plug-in hybrid and electric new car registrations in the UK, representing only 4.7% of all new car registrations. Autonomous cars feel tantalisingly close – but just how close are they? (I will leave other commentators to write about drones!) The changes will not be binary on the choice of mobility; touch one component of the mobility mobile and everything will move until a new equilibrium is found. Discouraging the use of diesel cars in cities will probably move pollution (and the need to find a solution to improve air quality) to another part of the country. If customers move from car ownership to car subscription, financing cars will move from a consumer finance model to a business finance model.

Some technologies have been present for many years but have not yet become mainstream. For example, 14 years ago Creditplus was the first company in the UK to sell a used car online to a customer that had not physically seen the car. In those days, it was difficult to sell a branded can of baked beans online! Today, less than 5% of all used cars are sold online, despite the technology to do so existing for many years. Change does not always happen as quickly as expected. Digital financing is still an underutilised channel compared to borrowing through traditional banks and dealers. Online platforms enable customers to gain knowledge about car choice without feeling pressured by a salesperson. It also enables customers to assess how much finance they can afford. Around two-thirds of customers choose a car before honing in on the amount of finance they can afford. However, customers’ desire for convenience, speed and for price comparison will encourage a shift away from traditional finance channels towards online channels. Those online platforms that can grow a trusted brand will benefit the most from this trend.

Looking to the future is key to the survival and success of all businesses. Judging how far into the future changes are likely to happen enables businesses to assess the amount and timing of investment and to plan for – and profit from – those changes that will actually happen. The changes we are witnessing and foreseeing in mobility are evolutionary rather than revolutionary. Over the next decade, people will still use cars; but some of those people will access cars using methods that are not mainstream today. Identifying those people that will behave differently in the future and those who will largely behave the same way as today is part of the challenge.

Understanding the fundamental reasons underlying why customers choose to access a car in a particular way and the choice of car is key. I believe there are (and have always been) four main criteria driving how people choose to get from A to B. These are:

- Where you live;

- How you live;

- Cost; and

- Desire for personal choice.

Technological advancement in recent years has increased the number of different ways people can obtain the use of a car. Not so long ago the choice of car travel ranged from a taxi service (probably hailed in a street or ordered from a landline phone) through to outright purchase. The spectrum of using a car is arguably no wider today, but there is more choice within that spectrum.

The introduction of hail riding such as Uber, car sharing such as ZipCar and car subscription such as Drover are relatively new ways to access cars for shorter periods of time, and more closely to where and when the car is required.

I will now look in turn at the four factors that determine how people access vehicles.

Where you live

Where you live will be one of the most important factors determining how a person chooses to get from A to B and will be the most important factor in changing the type and usage of cars over the next decade.

Whether a person lives in a city or other large conurbation (“urban areas”) or a rural area will be the most important factor driving their choice of mobility. This is principally down to the availability or non-availability of a number of the new services introduced in recent years. Generally, ride hailing and car sharing services will only be available in urban areas. In order for these services to work effectively, it is necessary to have a large number of cars as close as possible to a large number of people. Just over 19.5 million people live in urban areas with a population greater than 100,000, representing just under 30% of the UK population. In urban areas, ride hailing and car sharing services generally compete with public transport. Public transport offers a hub and spoke service, often requiring another mode of transport at either end of the journey, even if that is walking. Ride hailing and car sharing are point-to-point services (or close to it for car sharing) and therefore provide greater convenience that customers are often prepared to pay for.

Within a large city, such as London, the preferred method of mobility can vary too. The availability and cost of parking a car within a city centre counters the convenience of car sharing but this becomes less of an issue on the fringes of a city.

A serious issue is whether ride hailing and car sharing will displace investment by public bodies in improving public transport. Offering more licences to operate ride hailing or car sharing services will almost certainly be financially cheaper in the short term than adding new trains to an existing railway line or building a new railway line, but the increase in congestion and pollution could offset those short-term savings in the longer term.

The number of licenced taxis and private hire cars in London has increased from 72,000 in 2013 to 108,700 in 2017, representing a 50% increase. Earlier this year, the residents of Nashville, Tennessee voted against building a new, multi-billion dollar transit system in favour of using ride hailing services and eventually, autonomous cars. In 2017/18, for the first time in 20 years, the number of passengers using the tube in London fell by 2% to 1.35 billion. The number of journeys made on London buses fell by 6% between 2014/15 and 2016/17. The decline in passengers using public transport reflects the increase in work-from-home-days and the use of Uber. Projecting the longer-term effects of these changes is critical to ensuring that there is a balance between short-term financial objectives and longer-term goals. Technology can and will do many amazing things but whatever it can do now or in the future, there will always be a point at which a road has reached its capacity for cars.

Generally, public transport is more readily available within urban areas than rural areas and this is an obvious factor in determining whether passengers choose to use a car and, if they do, the best method to obtain access to that car. It is likely that individuals in rural areas will be more dependent on a car than people who have access to public transport.

Another critical element of the where you live factor is regulation. From 2019, an ultra-low emission zone will operate in Central London to help reduce pollution. Drivers of vehicles that fail to meet certain Euro emission standards will incur a daily charge. There is also a series of initiatives leading up to 2019 designed to encourage the use of lower emission cars such as the extension of the low emission zone to cover Greater London. Birmingham, Leeds and other UK cities have recently announced a clean air programme following London’s lead. Regulation is and will increasingly be a catalyst for changing the choice of vehicle depending on where you live. Currently, it is not foreseen that similar types of regulation will apply in smaller towns or rural areas. The Government’s total ban on selling new combustion engine cars in the UK from 2040 will eventually feed through to rural areas but I estimate it will take until 2050-2055 before non-combustion engine cars replace the UK’s current fleet of 32 million cars.

The success or otherwise of the cities to achieve their clean air targets will depend on their ability to install the necessary infrastructure to re-charge alternative fuelled cars, particularly charging points. The electric “plumbing” in the UK will need to increase substantially to cope with future demand otherwise the petrol queues seen during the tanker drivers’ strike in 2000 may be replaced by queues for electricity in the future. There is also a need for the grid to be able to cope with surges in demand for electricity at particulars times of the day.

The lack of parking spaces and the high cost of parking in a city discourage car ownership. Many areas operate resident parking schemes and limit the number of cars to two per household. Parking is generally free in rural areas and availability is not normally an issue. The number of spaces available to park in urban areas is unlikely to increase noticeably in the future. Car ownership in urban areas will continue to be negatively affected by parking considerations but a positive factor for ride hailing and car sharing as one car can replace the use of many cars using these services.

Where you live will have an increasing influence on the type of car chosen by customers and the method of obtaining the use of and financing that car. The use of ride hailing (regulation permitting) and car sharing in urban areas will almost certainly increase over the next decade but the relative cost and convenience of each of those services will determine the extent to which they actually grow. These new services depend on a large number of people being in a relatively small area. Ride hailing and car sharing are not expected to have as significant impact on the type of car or the method of obtaining the car by rural drivers over the next decade. The availability of new, alternative fuel cars and regulation are the carrot and stick underpinning the choice of car in urban areas in the future but will have less impact on rural areas.

"The partnership and expertise [TMC] offer is fantastic, whether it be around definitions of business mileage, taxation issues or even tweaking their system for us to solve issues that are quite specific to a dealership business, such as how to handle reporting for test drives."

How you live your life

How you live your life largely relates to your desire for convenience. How you live your life, for most people, changes overtime. For example, people in their 20s may find a small two-door car perfectly adequate for their needs. Later in life, as parents, they replace the two-door car with a people carrier. As the years advance and their parents’ reach older-age, a four-door saloon may become the car of choice.

The way a person lives their life can change within a year as well as over a number of years. One car may be fine for commuting to work and the regular school run but may be too small for the long drive for the annual holiday. Having the flexibility to choose what type of car is most suitable for a particular month or season is where car subscription starts to be particularly attractive. Car subscription may be an attractive solution where there is a need or desire to change the type of car reasonably frequently. However, where change is not so frequent, outright ownership used in parallel with “traditional” rent-a-car remains a cost effective option.

Ignoring cost for now, the how you live your life factor would generally favour car subscription schemes as it offers more flexibility than leasing a particular car for three or four years and outright ownership. Subscription may not be as flexible as car hailing or car sharing but it has a place in the car use spectrum, especially where a customer wants to use a car frequently over several months.

Cost

Cost is a critical factor in determining the type of car and the method of accessing the car. There are more similarities than differences between London black cabs and Uber. A major difference though is cost, and that has led to Uber taking a significant market share from the Black cabs.

All other things being equal, getting from A to B at the lowest cost is and will continue to be a major factor for most in deciding the mode of transport for a journey and mobility generally.

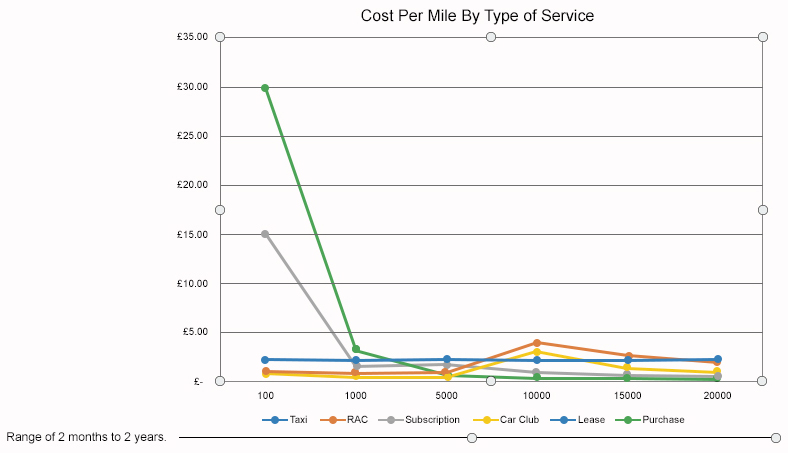

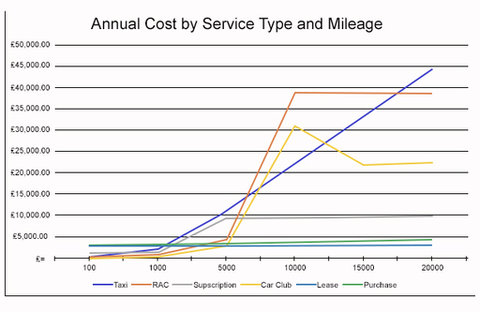

As a general proposition, it is likely that ride hailing, car sharing and rent-a-car will favour customers travelling a relatively low number of miles each year and subscription, leasing and outright purchase will favour customers travelling a relatively high number of miles each year. It is not entirely accurate to compare the cost of a ride hailing service with a car-sharing scheme; the former is a service that includes a driver, the latter is the hire of a car. The former will not incur any car parking charges whereas the latter might. For simplicity, to compare the costs of the various services, I have ignored the different nature of the services, the possibility that additional charges could be incurred as part of the overall journey and that surcharges and other variations might apply. However, I have included an estimate for driver insurance and maintenance. The graph below shows the estimated cost per mile of each type of access mode based on the annual mileage driven. As expected, taxi, rent-a-car, and car club are more cost effective for lower annual miles driven. Lease and purchase are more cost effective for high mileage drivers.

The second graph shows the total annual cost by type of service based on annual mileage. In particular, it highlights that there is a tipping point between 5000-6000 miles per annum where rent-a-car and car club cease to be cost effective and leasing and outright purchase are the cheapest way to access cars. At no amount of miles driven per annum is subscription the most cost effective method of accessing a car currently. This is in part due to subscription companies requiring a minimum 2 month subscription period and the relatively high cost per mile. Customers must therefore be prepared to pay a premium over other service types in order to enjoy the flexibility of a subscription service, or if the period they require a car for is in.

Mileage pa

Mileage pa

Desire for personal choice

As Henry Ford once said ”You can have any colour you want as long as it is black!“ Personal choice is another important factor for many but one I consider has less influence on millennials than older customers. Instinctively, I believe that customers are less concerned about the specific features of a product, the shorter the period of time they expect to have that product; I would not turn away my Uber ride because the car was not a particular colour!

On the other hand, I would prefer to drive a car with a satnav and a Bluetooth connection for my phone.

Customers who have a desire for a specific make and model of car and for that car to have specific features such as a particular colour, wheel-style, trim, satnav, Bluetooth, sound system, etc. are likely to be drawn towards lease or ownership. It is simply not economic currently for subscription schemes and other schemes offering relatively short-term usage of a car, to offer customers a bespoke car.

Consequently, customers with a strong desire for particular features in a car will lean towards leasing or ownership.

The next decade?

Over the next decade, where and how you live, technology, regulation, advances in manufacturing alternative fuel cars and cost are likely to be the main factors that shape the type of vehicles used and the choice of car usage by customers. The effect of the above developments will be clearly evident in urban areas but is not expected to have as significant impact outside of urban areas. This will lead to a stark difference between the type of cars used in urban areas (electric) and those used in rural areas (combustion engine). There will be a growing difference between how city-dwellers and rural-dwellers access cars. City-dwellers will look increasingly to short-term usage models such as ride hailing and car sharing. City-dwellers who seek to lease or own a car will increasingly look to electric cars. Rural-dwellers will continue to lease or buy cars outright, largely driven by cost and potentially benefiting from lower demand and prices for used diesel cars and then used petrol engine cars. In 2017, 13% of the UK population lived in London – but only 8% of the UK car fleet was registered to Londoners. This trend is unlikely to change in the foreseeable future.

Millennials will represent the largest population of car users in the next decade. Millennials living outside of cities will search for cars online, not just to gain knowledge and enable them to make better informed buying decisions but increasingly to buy used cars online from providers that offer convenience, assurances about the condition of the car and finance in a single transaction, in contrast to acquiring cars through dealers.

The trend of drivers owning their car for longer is likely to continue. Continued improvements in the quality of newly-manufactured cars and reduced demand from city-dwellers will see the UK’s used car fleet grow as a proportion of its total car fleet.

Customers increasingly expect convenience and speed. Online platforms that can deliver a “bean-to-cup” car buying and financing solution – one that is trusted by customers – are best placed to meet the future needs of customers.

contacts

PricewaterhouseCoopers

Paul Nash

Partner

Global Head of Asset Finance & Leasing

Phone: +44 (0) 1270 525 218