UK electric vehicle infrastructure might not be able to cope with plug-in numbers

The UK is behind on electric vehicle infrastructure, with insufficient charge points to charge vehicles, or mechanics to fix them, writes Globaldata analyst Chris Bertenshaw

Image copyright:

Scroll down or swipe up to read more

The UK is behind on electric vehicle infrastructure, with insufficient charge points to charge vehicles, or mechanics to fix them.

According to 2018 research from the Institute of the Motor Industry (IMI) in the UK, there is a significant shortfall in electric vehicle charging points and mechanics that are trained to work on hybrid and electric cars.

The IMI states that only 3% of mechanics in the UK are qualified to work on electric cars, the vast majority of whom are based in franchised dealerships. This significantly reduces both the capacity of the vehicle repair network and consumer access to local independent garages.

Not enough chargers to handle 1 million vehicles

The IMI states that on average across the UK, there is one public charging point available for every 8 hybrid and electric vehicles on the road at present and given the rate of growth in the industry, this is not enough.

Current estimates show this network will have to handle an electric and hybrid vehicle fleet of 1 million by 2020, putting this ratio at 55.6 vehicles to a charger, should charger numbers remain largely the same.

There are approximately 18,000 charging points across 6500 locations at present and the majority of these are slower charger types, less suitable for the much larger battery capacities of modern electric vehicles, with charge times taking hours in many cases. Charging such a large number of vehicles at such a slow rate would cause a large amount of transport disruption.

Hybrid and electric vehicle sales are strongat present

These statistics are concerning for the UK because hybrid and electric vehicle sales are very strong, yet UK infrastructure is not sufficientlydeveloped to support the current rate of growth.

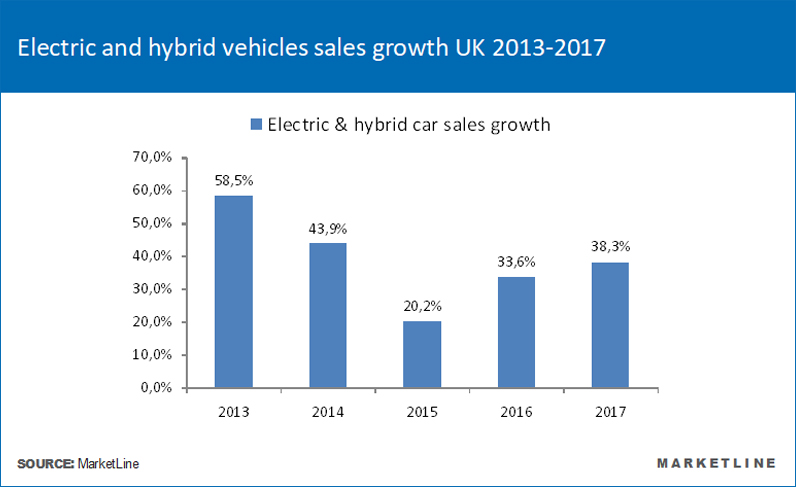

MarketLine analysis shows that in 2017 electric and hybrid vehicles sales grew by 38% year on year. 2018 is expected to show an even higher rate of growth due to the rapid collapse of diesel sales in the UK, estimated to be 30% fewer in 2018 than 2017 according to the SMMT.

Factors such as improved emissions results, company car tax incentives and improved fuel economy results are increasingly convincing consumers to purchase vehicles with electrified drive trains. But this transition in the UK is not being helped by a lethargic and inadequate infrastructure network, which makes efficient use of these vehicles more difficult.

caption

Hundreds of new electric vehicle models are about to become available

Worse still,the period between 2020 and 2022 is expected to be a turning point from the perspective of manufacturers, when the number of electric models is forecast to accelerate significantly. Volkswagen, for instance, expects to release a new electrified model every month in 2022.

Zap Map, a charge point locator in the UK, estimates that 60% of chargers in the UK are categorized as’fast’ which is a slower charging technology then the current standard, which is ’rapid’. If battery powered electric vehicles become the industry standard over the next four years as is expected, the UK will need to rapidly improve the size and speed of its charging network.

You can find out more at the MarketLine report.