Could the subscription model set car ownership and mobility on a collision course?

OEM offered apps may still be too much burden on the consumer compared to mobility services such as Uber

Image copyright:

Scroll down or swipe up to read more

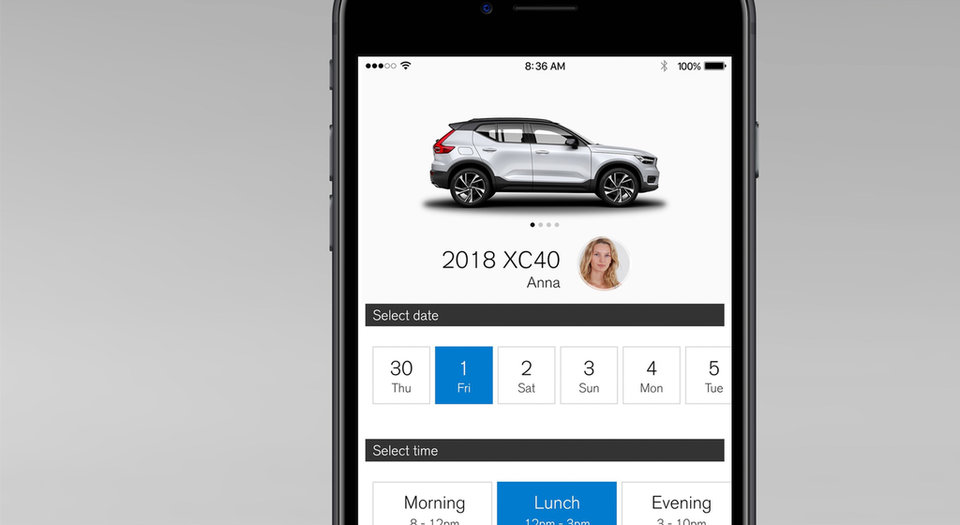

Car manufacturers as varied as Porsche, Jeep, and Volvo have long since identified car subscription as a viable model with the potential for mass adoption in the next ten years. The personal attachment to owning a car is fading amidst a generational shift, with young urban drivers leading the flexible mobility charge.

But what is the level of demand for switching cars on a regular basis? The prevailing assumption is that the industry has reached ‘peak car’ and that OEMs can only appeal to pre-existing customers. This might lend itself to a belief that a car subscription service with cars regularly switched means vehicles can keep coming off the factory floor.

Alternatively, younger users not dependent on ownership of a vehicle may switch to on-demand taxi apps. This would come with additional costs, but may be seen as offset by there being no responsibility to drive, park, or maintain the vehicle.

In November Uber announced a trial in five American cities of a monthly subscription service, which would protect the customer from the surge prices which have often led to criticism of the app and dismissal of its effectiveness as a regular transport option.

"We want to make Uber a reliable alternative to driving yourself - an affordable option people can use for their everyday transportation needs."

Uber product manager Dan Bilen

In a wide-ranging assessment, business consultancy firm Frost & Sullivan identified 38 current car subscription plans in the market across Europe and North America. Popular mobile taxi apps were included under the umbrella of ‘mobility provider programmes’ in the analysis. This included Uber, who in spite of a business model that is currently losing around $1bn every financial quarter is still able to pour resources into research and development that could one day see its human drivers replaced with autonomous vehicles.

Yet car subscription on a personal leasing basisis also noted as uniquely placed to revolutionise the market, specifically for its convenience and potential lack of tethering of the customer to any one OEM, vehicle, or longstanding finance agreement.

Competing more against something like Uber’s own high-end vehicle offering Lux is prestige car subscription services. Described as a ‘‘super premium OEM program’’, Porsche Passport is available to customers as an app, in which cars can be ordered and then delivered by concierge. Capitalising on the carmakers reputation as a luxury brand, the service is advertised with ‘‘drive a Cayenne on a Monday and a 911 on a Friday.’’ Currently, Porsche Passport is only available in Atlanta, Georgia, though it has plans to expand over the next twelve months.

Also in the report are three ‘mainstream OEM programmes’: Ford, Jeep, and Hyundai. The Jeep car subscription service, Jeep Wave, is due to be introduced from 2019. The deal was announced in June 2018 by Fiat Chrysler Automobile (FCA) as part of its five-year plan, and may come to include vehicles other than Jeep that exist under the FCA marque.

"Jeep’s three subscription plans will be titled “Good,” “Better,” and “Best”."

Also analysed is the impact of software and platform providers on car subscription. One of these is tech start-up Drover, who in April 2018 partnered with the BMW Group UK to offer BMW and Mini cars on a monthly subscription basis.

The product, offered through Drover’s website, bundles the cost of ownership, including taxes, servicing and insurance, under a single monthly payment, starting at £562 a month for a Mini Cooper 3-door Hatch.

Even something as seemingly responsibility free as Drover still operates on a monthly subscription basis, compared to the option being offered by Uber on a currently very limited trial. The subscriber may not own the car with subscription, but they are still responsible for aspects such as insurance and mileage.

It’s clear that the interconnected web of car subscription services is both permanent and ever expanding. The next key development in this area is in its effective marketing, and in the race against taxi app mobility also being able to escape the stereotypes of overcharging for extras and underwhelming choice that has set in the traditional car rental market.

To compete with taxi apps, car subscription also needs to push its relative advantages such as cost savings over time and lack of personal safety concerns. Without sorting out its reputation and presentation car subscription risks becoming little more than an alternative taken only out of necessity in rural and semi-rural locations, where the likes of Lyft, DidiChuxing and Uber are not yet available.