Image:

“It is incredibly tough out there,” says Mike Hawes, chief executive of the SMMT, who predicts that by the end of the year, there will be a circa 35-40% decline in both new car registrations and car manufacturing numbers in the UK. “That is huge and the real challenge will be moving into the last quarter and into 2021.”

Coupled with that, the SMMT expects to see a coalescence of the three main issues currently affecting the industry as we edge closer to 2021.

The first issue is Covid-19 and the end of the furlough scheme. The figures speak for themselves regarding the impact of the virus on the UK automotive sector. However, as the furlough scheme – which proved to be an effective lifeline for many companies – morphs into the Job Retention Scheme, we have to wait and see how firms respond to the change in policy. “We hope it does safeguard some jobs as we want to minimise our redundancies and maximise the retention of the skilled workforce we have,” notes Hawes.

The second issue the industry must come to terms with is the end of the Brexit transition period at the end of the year. “Come what may we will be leaving the transition phase with the EU at the end of this year,” says Hawes. “We still don’t know whether we’ll have a trade deal or not. However, even if we get a deal – we are still leaving the customs union and we are still leaving the single market. The issue of preparation and making sure companies are prepared to trade in a different way is still there.

We don’t just need a date, we need a strategy. We need a plan that is about committing to incentives for the long-term.

“There is a strong urge for companies in all sectors to make the appropriate preparations if they are going to be exporting. However what we don’t know is the terms of the trades and tariffs – that will have an impact on the industry in the last quarter as companies try to prepare. We are also extraordinarily nervous about the threat of 7,000 lorries being parked up in Kent and how that will affect the just-in-time supply chain.”

The last issue highlighted by Hawes is the conclusion of the consultation on bringing forward plans to end the sales of conventional petrol and diesel engines – which promises to have a dramatic impact on the industry over the next 10 years.

Hawes says the SMMT is committed to its view that there needs to be clarity and substance to any commitments: “We don’t just need a date, we need a strategy. We need a plan that is about committing to incentives for the long-term. It is that compelling infrastructural investment to be able to reassure consumers that these are technologies they will be able to use and operate and that the infrastructure is there.”

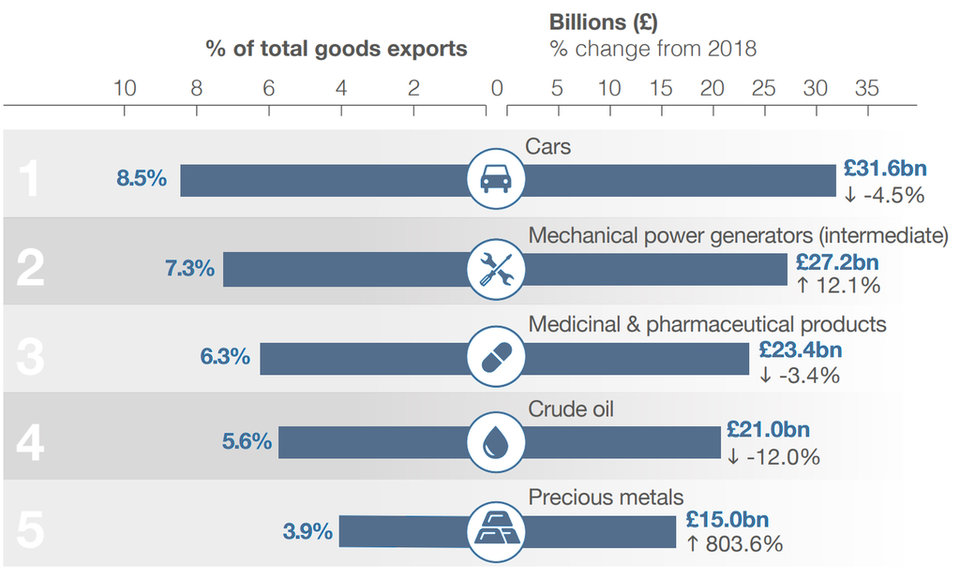

Top 10 UK goods exports (2019) – official government UK trade figures

The economic impact

The UK automotive industry is incredibly important to the UK, worth more than £82bn turnover and adding £18.6bn in value to the UK economy. More than 800,000 people are employed across the automotive industry, while auto accounts for 14.4% of total UK exports of goods – worth £44bn.

Speaking at the Open Forum, Andrew Burn, partner and UK head of automotive at KPMG, outlined what the next 12 months could look like from an economic perspective, with predictions centred around a V-shaped recovery.

There is an expectation that unemployment is likely to remain at a high level and will remain persistent for “much longer than we have seen previously”.

“We’re anticipating that unemployment will rise from the current figure of 5.9% to 8.3% in 2021. The chancellor’s measures have helped to delay and soften the curve of increased unemployment, but talking to companies across multiple sectors, what is very clear is that there is no question that unemployment will continue to rise. Particularly as we head into the backend of this year and the beginning of next.”

Burn adds that in a historical context, unemployment has been slow to recover when it has reached such high levels.

There is therefore an expectation at KPMG that unemployment is likely to remain at a high level and will remain persistent for “much longer than perhaps we have seen previously”, when taking into consideration the rapid and immense economic shock caused by Covid.