- ECONOMIC IMPACT -

Latest update: 22 November

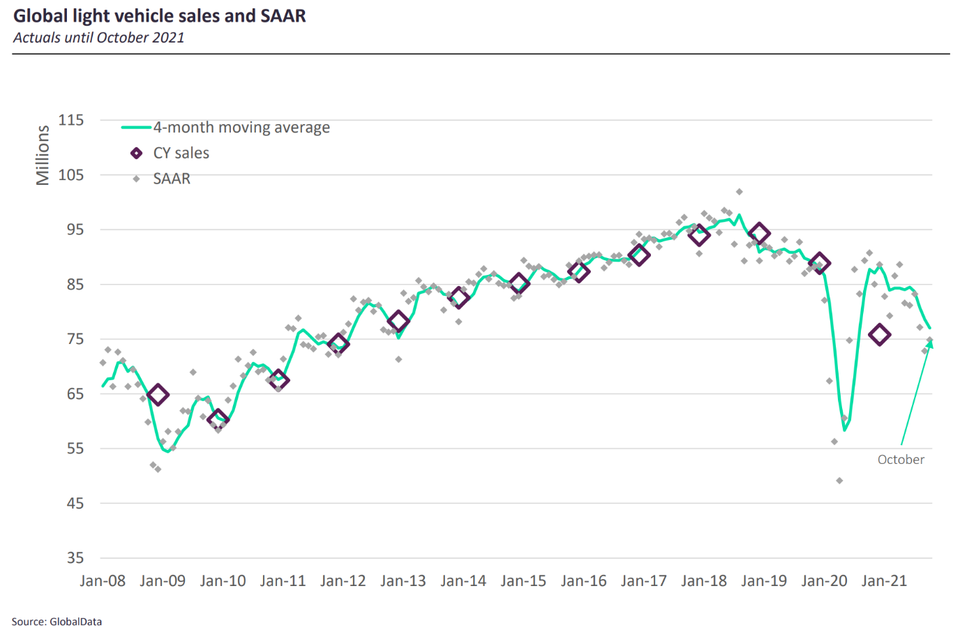

October’s sales finished broadly in line with expectations as inventory issues continued to bite. There was a marginal improvement in the SAAR for October with the rate easing up to 74.8m from September’s 72.8m.

The sales declines that began in August were a watershed moment for not only the 2021 outlook, but also for what 2022 and beyond will look like. September’s and October’s results confirmed the tailspin that sales entered.

84.1m

GlobalData’s forecast for the total car sales this year sits at 84.1m

1.99m

The UK’s car sales forecast for 2021, a 3% increase on the previous year

Impact of Covid-19 on Vehicle sales

- SECTOR IMPACT: Automotive -

Latest update: 22 November

Regional impact

-28%

Sales in West Europe decline 28% in October

-22%

North America saw the largest decline outside of MEA

SALES OUTLOOK

Globally we expect declines to taper in the final two months - -10.7% pencilled in for November and -9% for December as supply eases. But once again all eyes in the northern hemisphere, especially in Europe, will be on surging Covid cases and tightening social restrictions.

The current lack of momentum is expected to continue into H1 2022, but with build back by OEMs mounting as we progress through the year improved supply should see sales pick up in H2. Nevertheless the market’s stall in the first half of the year will still see a market of just 84.1m – about the same level we would have expected for 2021 if the chip crisis hadn’t intervened.

OEM RECOVERY

October’s sales finished broadly in line with expectations as inventory issues continued to bite. There was a marginal improvement in the SAAR for October with the rate easing up to 74.8m from September’s 72.8m.

However, for recent context the rate was still the lowest October since 2011 when markets were recovering from the global financial crisis.

The picture of declining sales and production shutdowns has been further embellished with a succession of industry CEOs not seeing an end to the chip shortfall to 2002 or even 2023. Quite a change from the brighter prospects for supply in H2 2021 that all had considered on the cards before.