- ECONOMIC IMPACT -

Latest update: 9 April 2020

Many economists have cut their GDP forecasts. The 2020 consensus forecast for GDP growth is currently negative and many predict a recession.

Unemployment rates are expected to rise in all major economies. The International Labour Organization estimates 25 million job losses worldwide.

2.4% - 1.5%

The OECD's forecast for global growth in 2020, with some consensus estimates being far lower

$2-3 trillion

Expected reduction in investments in the commodity-rich exporting nations, according to UNCTAD

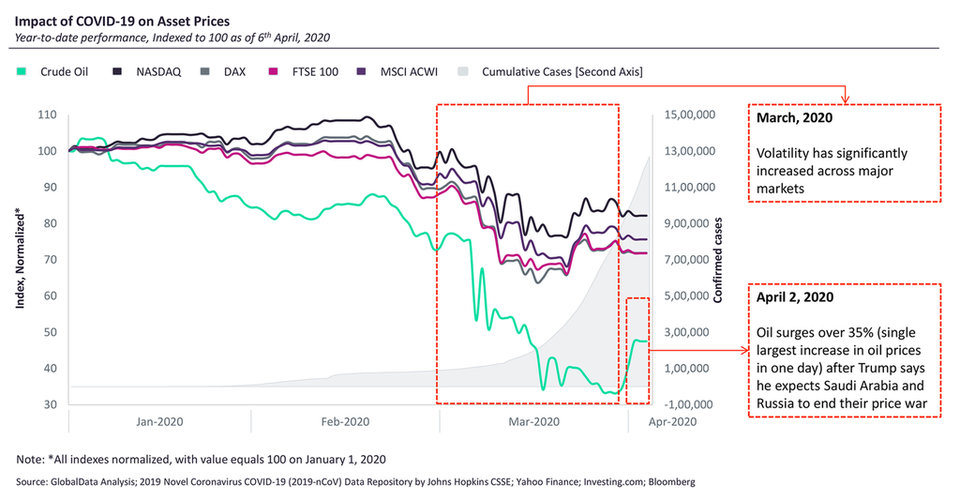

Impact of Covid-19 on asset prices

- SECTOR IMPACT: AUTOMOTIVE -

Latest update: 9 April 2020

The automotive sector is facing its biggest existential threat since the 2007–2009 financial crisis with multi-dimensional challenges. These include supply chain restrictions, workforce safety, and demand precipitation.

15.8%

GlobalData’s base Covid-19 scenario forecasts a fall in light vehicle sales of 15.8% on 2019. This scenario assumes actions to suppress the virus are successful and economies do not suffer much damage.

$113.3bn

The loss in potential revenue caused by the removal of 3.5 million light vehicles from production schedules in Europe and North America over the past few days, according to GlobalData estimates.

Sales in the US fell by 38.2% YOY in March, the worst performance in the month since 2009.

In major European markets, sales in March fell 46.3% YoY according to GlobalData analysis.

13.6 million

Base production forecast for North America, down 2.9 million from GlobalData’s earlier forecast

16.7 million

Base production forecast for Europe, down 15.7% from GlobalData’s previous forecast