Cover Story

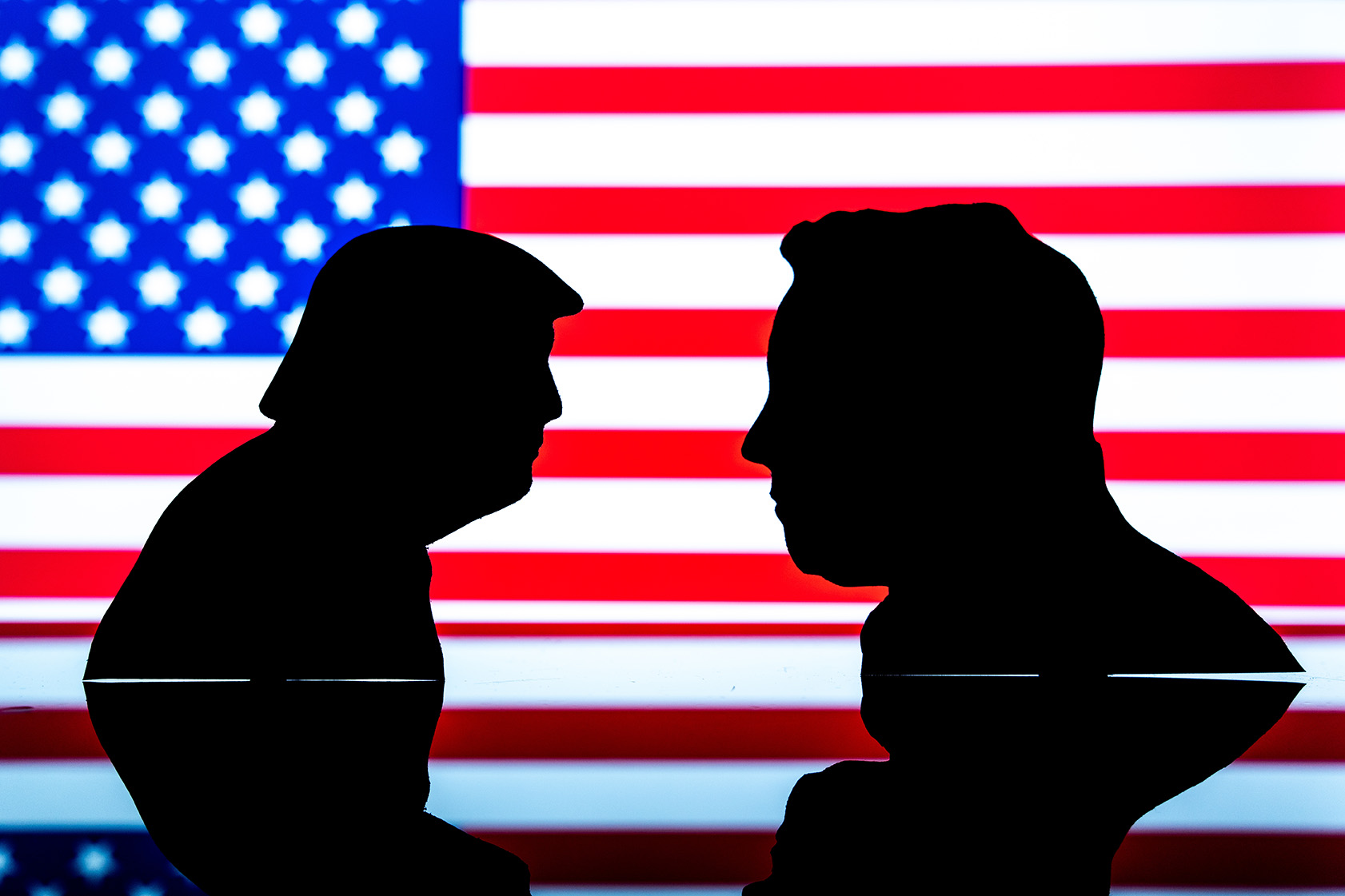

Trump and Musk: the bromance that will reshape EV policy

Four turbulent years could redefine the trajectory of EV motor financing and the future of green finance worldwide, Alejandro Gonzalez reports.

Credit: Rokas Tenys / Shutterstock

The global electric vehicle (EV) market has reached a pivotal moment. After years of steady growth, with EVs nearly doubling their global market share from 10% to 17.4% in two and a half years, the sector faces a future clouded by political uncertainty. The unexpected alliance between President-elect Donald Trump and Tesla CEO Elon Musk, a pairing that might once have seemed inconceivable, has created a paradoxical dynamic. While Musk’s expertise and Tesla’s dominance in EVs could bolster the industry, Trump’s campaign promises to dismantle Biden-era climate policies risk undermining broader green ambitions.

The next four years of US leadership could determine not only the trajectory of EVs globally but also the world’s progress towards net-zero emissions. These outcomes hinge on the durability of the Trump-Musk partnership, which is already raising questions about the intersection of policy, innovation, and political stability.

EV momentum

EV sales are soaring worldwide, with over 10.8 million units sold globally in the year to October 2023, representing an 11% increase over the previous year, according to data from New AutoMotive’s latest Global Electric Vehicle Tracker.

Yet, the US — one of the world’s largest EV markets — is entering uncertain terrain.

On the campaign trail ahead of his election victory in 2024, Donald Trump railed against EVs, renewable energy, and climate policy.

Speaking to crowds across the United States, he painted the Inflation Reduction Act (IRA) — a Biden-era law providing tax credits for EVs and funding green energy projects — as an emblem of government overreach.

He pledged to redirect money from the “green new scam,” and promised to bring the US back to $2-a-gallon gas.

These remarks, among others, resonated with voters, propelling Trump to a commanding victory in November. His return to power, bolstered by Republican control of Congress and the House of Representatives, has raised questions about the future of EVs, both in the US and abroad. Adding intrigue, Tesla CEO Musk — the world's richest man — was named a key policy adviser shortly after the election.

The morning after the U.S. election brought contrasting fortunes for automotive stocks, as internal combustion engine (ICE) suppliers saw notable gains while most EV-related stocks declined — except for one prominent outlier.

According to Seeking Alpha News, shares of ICE-focused auto parts suppliers rose significantly, including Commercial Vehicle Group (+11.9%), Douglas Dynamics (+9.3%), Stoneridge (+8.0%), Dana (+7.7%), Allison Transmission (+6.8%), and PHINIA (+8.0%).

Meanwhile, EV-related companies experienced a downturn. Stocks fell for ChargePoint Holdings (-10.4%), Niu Technologies (-6.6%), Blink Charging (-8.1%), EVgo (-7.5%), Polestar Automotive (-5.8%), Hesai Group (-5.5%), Innoviz Technologies (-2.3%), and QuantumScape Corp. (-2.1%).

Tesla, however, defied the broader EV stock trend, posting an 11.6% increase — the largest gain in the automotive sector post-election. Tesla's surge is widely attributed to Musk’s ‘bromance’ with Trump, with whom Musk celebrated on election night.

From the campaign trail to the White House

Trump’s 2024 campaign capitalised on economic grievances, particularly in regions dependent on fossil fuels and traditional auto manufacturing. He criticised EV subsidies as elitist and claimed that Americans were being coerced into buying vehicles they didn’t want, telling his political rallies that EVs are expensive, unreliable, and are killing jobs, and vowed to dismantle Biden’s climate policies and withdraw the US from the Paris Agreement.

Once in office, Trump wasted no time signalling his intentions. Within weeks, he appointed Musk to lead a new Office of Government Efficiency, or DOGE, charged with reducing federal “waste.” Musk’s mandate included advising on cuts to federal agencies and regulations, some of which directly affect Tesla’s competitors and the broader auto industry.

Adviser and industry titan

Musk’s dual role as a White House adviser and Tesla CEO has sparked intense debate. Critics question whether his position presents a conflict of interest, given Tesla’s dominant market share in the EV sector.

Musk is now uniquely positioned to influence policies that could tilt the playing field in Tesla’s favour. Tesla has thrived under the IRA, using its subsidies to lower vehicle prices and maintain profitability. Musk, however, has long argued that Tesla could compete without government support. “Take away the subsidies; it will only help Tesla,” he said in a July post on X, the social media platform he owns.

But while Tesla may weather the storm, other automakers are more vulnerable. Companies like Ford and General Motors rely heavily on federal tax credits to make their EVs competitive. “Rolling back these credits will make EVs more expensive, especially for those leasing vehicles,” said Ed Kim, president of AutoPacific.

Leases, which accounted for 32% of US EV contracts in 2024, have been key to driving adoption but could lose their appeal without tax incentives.

Net Zero leadership

The US’s retreat from green policies could create opportunities and challenges for other regions. European automakers, who have invested heavily in EV production, may scale back their ambitions if US demand contracts. At the same time, reduced competition from Chinese automakers in the US — due to Trump’s proposed tariffs — could intensify their push into European markets. BYD and Xpeng, for example, are already establishing local production facilities within the EU to bypass potential trade barriers.

Klisman Murati of Pareto Economics highlights the tough decisions Chinese manufacturers face: “It’s either move your operation to the US to avoid paying these tariffs, take the hit with these tariffs, or find new markets for your production. There is a fourth option, which is lobbying to have your products exempted from these tariffs, but not everyone will take that” he’s reported telling the finance press in the US.

Globally, EV sales remain strong, with emerging markets like Bulgaria, Cyprus, and Malta posting record growth. However, sustaining this momentum requires stable policies. Ben Nelmes, CEO of New AutoMotive, underscores the importance of government consistency, stating: “This sustained growth is vital to the world’s transition to cleaner, cheaper transport, and governments around the world need to hold their nerve when it comes to EV policy.”

The motor finance sector, a critical player in the EV ecosystem, is particularly attuned to global barriers and incentives. Leasing, which has driven much of the recent EV adoption in both the US and Europe, could face headwinds if Federal support in the US wanes. However, the UK and several European nations, buoyed by record EV sales, may be better positioned to weather disruptions.

The road ahead

As a key Trump adviser, Musk is not just well positioned to wield substantial influence over the new administration’s approach to EVs.

Jessica Caldwell, head of insights at Edmunds, highlighted Musk’s longstanding support for the broader EV market. She noted that even if Trump eliminates consumer incentives, Musk might work to ensure continued EV adoption through alternative means. “From the beginning, Musk has made it clear that he wants to see the EV market succeed beyond Tesla, so he may try to influence a new incentive structure that continues to support broader EV adoption in the US,” Caldwell said.

Musk’s reach extends well beyond EVs. His companies, such as SpaceX, which relies heavily on government contracts, and Tesla, a leading beneficiary of federal funding for EV charging infrastructure, stand to gain — or lose — depending on his ability to navigate a potentially fraught political landscape.

His new role could also enable him to shape critical areas like artificial intelligence policy, benefiting his AI company, xAI. Furthermore, his influence may extend to regulatory agencies such as the National Highway Transportation Safety Administration, which is currently investigating Tesla’s autonomous-driving technology.

While Musk’s influence holds the promise of opportunities for innovation and efficiency, the volatile dynamics between two strong personalities —Trump and Musk — pose significant risks. Both men have a track record of impulsive decision-making and are known for prioritising their individual visions over collaborative consensus. For the motor finance sector, this volatility creates profound uncertainty.

At the outset of a four-year presidency, the industry faces the prospect of a disrupted, rather than clarified, regulatory and financial landscape. The success of this ‘bromance’ may ultimately depend on whether these two dominant egos can coexist long enough to bring coherent strategies to fruition — or if their partnership collapses under the weight of conflicting priorities and political theatrics.