Thought Leadership

Sponsored by Alfa

The Intersection of Sustainability and Scalability in Automotive Finance

In the world of automotive finance, the drive to scale up business can come into tension with obligations to drive down emissions. New innovations mean that scalability and sustainability needn’t be mutually exclusive.

Main image credit:

As the world continues to adopt greener practices, the pressure for auto finance providers to operate sustainably has also grown. Simultaneously, they also face the need to scale efficiently to remain competitive in a global economy. Sustainability initiatives include greenhouse gas (GHG) reporting, reducing carbon emissions, and using energy-efficient resources, while scalability requires the flexibility to grow, adapt, and handle increasing demand. These two goals can seemingly be at odds but, with the right technology tools, they can be effectively combined.

Adopting innovative solutions has become crucial for auto finance providers to merge these objectives successfully. Through strategic financing, companies can invest in energy-efficient vehicles, green technologies and processes that not only reduce their environmental impact but also support their growth ambitions.

Automotive Finance and Sustainability

Automotive finance plays a significant role in supporting businesses looking to scale sustainably. It allows companies to acquire the necessary vehicles without having to buy outright, conserving capital while enabling investment in required assets. This method offers flexibility, as businesses can adapt quickly to market changes without being weighed down by large, up-front capital investments.

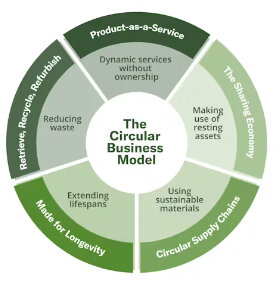

It also encourages companies to rethink their approach to asset lifecycle management. Instead of purchasing vehicles that can become obsolete relatively quickly, firms can lease or finance these, which they can then upgrade or replace with more efficient, eco-friendly options when needed. This model supports the circular economy, where the focus is on reusing and recycling assets, thereby reducing carbon and waste footprints.

The shift towards asset lifecycle management is a potential game-changer. Companies can better manage their assets over time, ensuring they are operating at peak efficiency and are sustainable throughout their lifecycle. This approach not only aligns with regulatory requirements but also caters to increasing customer expectations for eco-friendly practices.

Regulatory Compliance and Competitive Advantage

As governments and regulatory bodies place increasing pressure on businesses to comply with environmental regulations, the role of automotive finance in helping companies meet these standards becomes more important. Innovations in financing not only assist companies in acquiring green vehicles but also help track their environmental performance, ensuring they meet both local and international regulations.

The ability to remain compliant while being cost-effective is crucial for businesses in the current regulatory environment. As companies expand, they must invest in solutions that not only allow for growth but also keep them aligned with global sustainability targets.

By adopting innovative technology, businesses can turn compliance into a competitive advantage. Consumers are increasingly eco-savvy and companies that can demonstrate a commitment to sustainability are better positioned to win these customers. Furthermore, sustainable practices can result in cost savings, especially in terms of energy efficiency and waste reduction, which ultimately benefit a company's bottom line. An approach that aligns growth with ESG criteria increasingly influences investor decisions also.

Growth vs. Sustainability?

One of the biggest challenges for businesses is finding the right balance between short-term growth goals and long-term sustainability objectives. Traditionally, companies have prioritised immediate expansion over eco-friendly investments, but this mindset is shifting. More businesses are recognising that sustainability is not just a buzzword but a long-term strategy that can drive profitability and competitive edge.

Technological innovations are key enablers of both sustainability and scalability. With cloud-based platforms, real-time data tracking, and a focus on asset lifecycle management, companies can simultaneously grow and reduce their environmental impact.

Total Originations in Alfa Systems 6

Technological Innovations Driving Change

So what do these innovative finance solutions look like in practice? One prominent solution is Alfa Systems 6. The latest iteration of Alfa’s market-leading SaaS platform for auto finance, it is a case study in how technology can help to bring scalability and sustainability together.

Alfa Systems 6 gives finance providers everything they need in a single stable product. One of its core strengths is its dynamic resource optimisation. Utilising cloud-native technologies, the platform provides adaptable resource models ensuring that resources are used efficiently. This both reduces costs and shrinks firms’ environmental footprints. Integration with AWS Aurora's serverless technologies allows for real-time scaling based on demand.

The ability to host in the cloud and provide support around the clock gives auto finance providers a clear competitive advantage in their ability to originate deals across geographical borders, launch new asset finance programmes in multiple markets, and monitor cross-company customer risk for better credit decisions.

This is also ideal for the onboarding of new portfolios, where tooling and automated processes also facilitate the quick and painless transfer onto the platform, reducing downtime and ensuring a smooth transition. Always-on capabilities in Alfa Systems 6 further ensure that digital self-service operations are always available, enhancing customer satisfaction and operational efficiency.

Although geared towards business growth, sustainability sits at the platform’s heart. It enables oversight of the entire vehicle finance lifecycle, from origination to end-of-life. This includes inventory management for reuse, short-term second and third lives, and streamlined refurbishment processes. By maximising the use of existing vehicles, auto finance providers can reduce waste and promote a circular economy.

Alfa Systems 6 also supports subscription models, enabling companies to offer vehicles on a usage basis and the transition from capital expenditure (CapEx) to operational expenditure (OpEx). Fully configurable, this includes dictating how the subscription is billed, as well as the core accounting.

Decision-makers in major green transition industries like EVs can manage entire fleets at the click of a button. But auto finance providers are also realising the opportunity to create new revenue streams by financing new energy streams and EV infrastructure.

Configurable asset classifications allow for alternative-fuel vehicles, as well as wall chargers and batteries, to be modelled and configured. The ability to support multi-asset contracts with a complex structure of financial elements is fully supported by Alfa Systems 6. Costs can be added against each asset, or against the contract which allows for balance-affecting optional products, such as different maintenance amounts for charger and vehicle, to be defined for each asset.

Alfa Systems 6 also supports the addition of ad hoc charges, such as those due for charging fees, as well as the toggling of subscriptions, such as priority access to charging networks, via the API. This allows in-vehicle technology to work in harmony with accounts receivable systems in real time.

Alfa Systems 6 is a flexible, customer-centric technology platform which matches the customer-focused approach taken by many auto finance companies. It supports consolidation of amounts due resulting in one single bill for the customer. The ability to bundle amounts due from different contracts, multi-asset contracts, subscription charges and ad hoc amounts due - such as charging fees - results in a seamless, flexible and accurate experience for the customer.

Furthermore, the Scope 3 emissions calculator allows finance providers to track and report on GHG emissions; and the platform's robust governance, risk, and compliance (GRC) processes - certified by ISO 27001 and SOC 2 - ensure data security and regulatory compliance, providing transparency and reducing the complexities associated with regulatory requirements.

A path forward

The intersection of sustainability and scalability is no longer just an aspiration but a practical reality for businesses willing to adopt the right technology.

Just as they have done through years of economic uncertainty and geopolitical instability, innovative auto and asset finance continues to provide a firm hand on the commercial tiller. Through continuous innovation and a commitment to environmental stewardship, Alfa Systems 6 exemplifies how technology-driven finance can propel business growth and sustainability forward together.

Contact information

Alfa

Moor Place

1 Fore Street Avenue

London EC2Y 9DT

Email: sales@alfasystems.com

Web: www.alfasystems.com