INSIGHT

Databank – November 2021

The latest data from around the automotive industry

Motor finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Sept-21 | % change on prev. year | 3 months to Sept 2021 | % change on prev. year | 12 months to Sept 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 2,179 | -25 | 4,498 | -20 | 17,099 | 6 |

| Number of cars | 93,617 | -27 | 194,554 | -23 | 728,694 | 0 |

| Used cars | ||||||

| Value of advances (£m) | 1,797 | -4 | 5,162 | -6 | 18,317 | 12 |

| Number of cars | 120,337 | -15 | 359,514 | -14 | 1,345,240 | 5 |

| Total cars | ||||||

| Value of advances (£m) | 3,976 | -17 | 9,660 | -13 | 35,415 | 9 |

| Number of cars | 213,954 | -21 | 554,068 | -17 | 2,073,934 | 3 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Sept-21 | % change on prev. year | 3 months to Sept 2021 | % change on prev. year | 12 months to Sept 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 31,449 | 9 | 77,504 | 5 | 323,661 | 15 |

| Used cars | ||||||

| Number of cars | 4,127 | -21 | 11,071 | -23 | 50,491 | -10 |

Analysis: Geraldine Kilkelly, director of research and chief economist at the FLA

Supply issues in the new car market caused by the shortage of semi-conductors continue to hamper the recovery of the automotive industry following the pandemic. New business volumes in the consumer new car finance market fell for a second consecutive month in August and the near-term outlook is likely to be weaker than previously expected.

By contrast, the consumer used car finance market remains relatively strong, with annual new business by value in August only 1% below its pre-pandemic peak.

Motor industry statistics (SMMT)

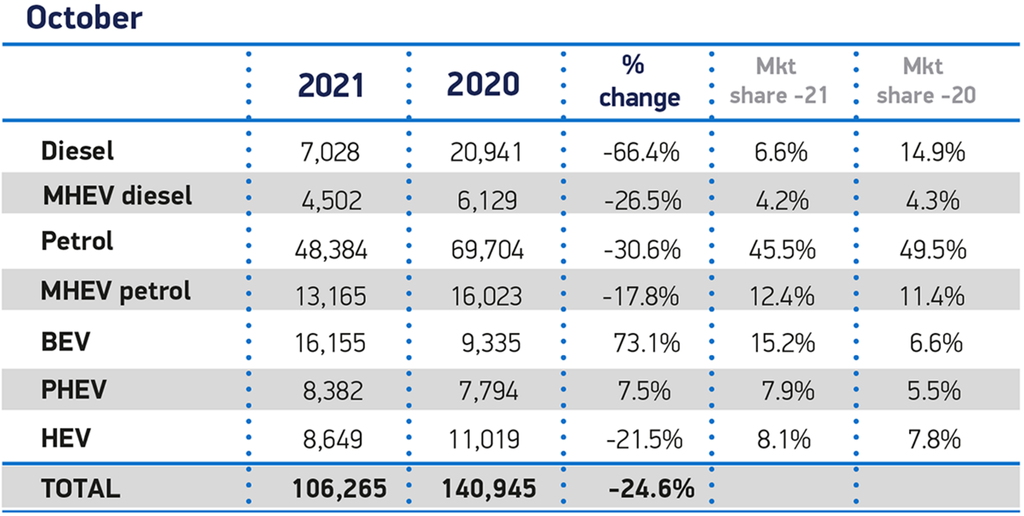

New car registration by vehicle type

Analysis: Mike Hawes, chief executive at the SMMT

Mike Hawes, SMMT chief executive, said: “The current performance reflects the challenging supply constraints, with the industry battling against semiconductor shortages and increasingly strong economic headwinds as inflation rises, taxes increase and consumer confidence has weakened.

“Electrified vehicles, however, continue to buck the trend, with almost one in six new cars registered this year capable of zero-emission motoring, growth that is fundamental to the UK’s ability to hit its net zero targets. With next year looking brighter, and even more new models expected, the continuation of this transition will depend on the preservation of incentives that overcome the affordability barrier, and the ability of the public and private sectors to increase public on street charging to allay EV driver concerns.”

Europe focus (ACEA)

| Oct-21 | Oct-20 | %Change 21/20 | Jan-Oct 2021 | Jan-Oct 2020 | %Change 21/20 | |

| France | 118,519 | 171,050 | -30.7 | 1,378,892 | 1,337,748 | +3.1 |

| Germany | 178,683 | 274,303 | -34.9 | 2,196,244 | 2,316,134 | -5.2 |

| Italy | 101,015 | 157,188 | -35.7 | 1,266,629 | 1,123,523 | +12.7 |

| Spain | 59,044 | 74,228 | -20.5 | 706,998 | 669,664 | +5.6 |

| United Kingdom | 106,265 | 140,945 | -24.6 | 1,422,879 | 1,384,601 | +2.8 |

| Total (EU + EFTA + UK) | 716,849 | 1,024,590 | -30.0 | 8,963,962 | 8,769,653 | +2.2 |

Analysis

In October 2021, new passenger car registrations in the European Union contracted further (-30.3%), marking the fourth consecutive month of decline this year. With 665,001 units sold across the region, this was the weakest result in volume terms for a month of October since records began. Most EU markets suffered double-digit losses, including the four largest ones: Italy (-35.7%), Germany (-34.9%), France (-30.7%) and Spain (-20.5%).

Over the first 10 months of 2021, new car registrations in the EU were up 2.2% compared to one year earlier, totalling around 8.2 million units. Despite the recent drop in sales due to the ongoing impact of the semiconductor supply crisis, substantial gains earlier in the year helped to keep cumulative volumes in positive territory. Likewise, demand remained positive in three out of the four key EU markets: Italy (+12.7%), Spain (+5.6%) and France (+3.1%). By contrast, Germany’s year-to-date performance has worsened compared to one year ago (-5.2%).