Employment

Auto industry ready to witness job losses and major skill transitioning

The transition to electric mobility has started impacting the employment structure in the automotive industry as a slew of OEMs and component suppliers have announced planned cuts to their employment numbers due to the shift to electrification. European OEMs are the most proactive on this front. Outside Europe an almost equally gloomy picture is painted

Employment levels in the automotive sector are constantly under threat as OEMs and supplier seek to wring greater margins from their operations, while the economic and operational disruption from the COVID-19 pandemic has compounded the issues.

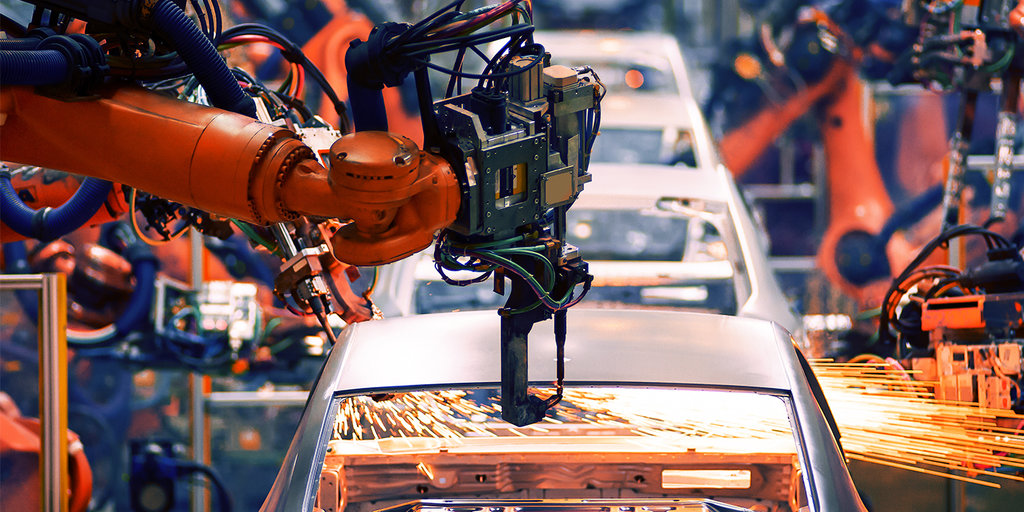

In the ICE age, the systemic pressures were present due to increasing digitalization, automation and robotics – i.e. the transitioning to industry 4.0 to break away from the labor-intensive traditional model. The age of electrification, with vehicles that are simpler to manufacture due to fewer parts and without the need for such an expansive in-house and external powertrain value chain is precipitating new pressure on automotive employment.

Over and above these factors, there is also the angle of share mobility/subscription models that comes into the picture aiming to reduce car ownership over time and bring down parc and new sales. The factors suggest that job losses in the auto industry were already on the cards but the shift to electrification will deepen the magnitude of the employment woes.

Thus far the job losses that have the shift to electrification as the primary theme tally to nearly 70,000 among the OEMs. Looking into the supplier network a similar position is reported. In Europe alone, Robert Bosch and GKN have announced jobs cuts and plant closures due to the shift away from ICE powertrains.

Unions in Europe predict that millions of jobs could be lost. With a VW analysis positing that 12% of the automotive workforce in Germany alone is threatened by electrification it’s easy to see how unions’ concerns could be scaled up to a sector that employs 14.6m people directly and indirectly in Europe according to ACEA.

There are ongoing debates on the intensity at which the jobs will be impacted. Several bodies across the globe have given their estimates The German Association of the Automotive Industry (VDA) estimates 215,000 jobs to be affected by 2030 in Europe and a report by the US-based Economic Policy Institute estimates the loss of 75,000 jobs by 2030 in the country. Germany’s National Platform Future of Mobility (NPM), a government advisory body, said in a report in early 2020 that more than 400,000 jobs in the country’s car industry could be gone by 2030 in a worst-case scenario involving a rapid switch to electric vehicles.

While on the flipside, some reports expect the job market to see major upskilling of the technical workers in OEM plants and the impact would be more on those working with component manufacturers for powertrain parts and ancillaries. Even so, it’s still a number that’s substantially comparable to those employed with automakers.

Additionally, the race to replace powertrain manufacturing networks with battery gigafactories, e-motor facilities and related hardware and software will bring some upside. This is evident in the recent shortage of research and engineering specialists that major South Korean battery giants LG, SK and Samsung are grappling with.

However, there’s no escaping the fact that EVs are simpler to manufacture than ICE vehicles. Allied with automation shifting more to center stage in manufacturing a decline in the required manpower in the auto sector is inevitable. Automakers are getting future-ready with phased layoffs and related announcements.

The industry would also see a transition in the kind of skillset required in the auto industry. Higher demand for skill across areas including chemical, material, electronics and IT is foreseen over mechanical jobs.