Thought Leadership

Sponsored by Alfa

A Vision for the Future of our Product

In motor finance, challenge and opportunity are always close - from sustainability reporting and green financing, to post-Covid headaches and the ever-changing economic environment. How can technology help to ensure auto finance providers survive and thrive?

Main image credit:

The global market right now is sparing and risk-averse in nature. Budget is becoming more elusive, with indications that this will continue throughout 2024. As the cost of capital rises and regulatory demands escalate, it is essential that automotive finance companies reduce operating costs, but at the same time maintain competitiveness.

An evolving landscape, marked by moves towards new product types and business models in order to sustain margins, such as trends in direct lending and subscription-based offerings, has led to heightened complexity in the business environment. Compelling developments include the emergence of new asset types, not all of which rely on franchised dealers. There's greater accessibility to customer data, with the increasing acceptance of modern data sources like Open Banking, facilitating the safe expansion of originations volumes. Regulatory, supplier and consumer pressures are further initiating changes to reporting, financial products and compliance.

For example, in a post-Covid world with the experience of lockdown defaults, there has been a gradual roll-out of more complex credit decision rules at different stages of the contract lifecycle, where more in-depth scrutiny is now being applied to regular supplier and dealer checks, contract amendments and collections.

And on the road to net-zero, business leaders are increasing their focus on sustainability. The transition to EVs, usage-based products and pricing, as well as more sustainable financing business models, has accelerated a greater focus on the circular economy and maximising value from the vehicle lifecycle.

Caption. Credit:

There is also a growing pressure to be ‘always on’, with instant connectivity to dealer and broker meaning customers demand 24/7 servicing power in a world where scale is no longer an excuse.

The adoption of innovative technologies is empowering automation, ushering in a new era of efficiency. Users can benefit from easy, invisible integrations with custom service providers, such as intelligent document reading. The use of no-code integration layers, as well as workflow and rules that incorporate business logic, can streamline processes further. Document metadata or KYC data can be compared with data from credit snapshots, with business rules triggering automated workflows or a feed into credit decision engines and scorecards, resulting in rapid, automated responses for a large proportion of decisions. This heightened level of automation releases valuable resources, leaving users time to deal with more complex, higher-margin transactions.

With this ever-changing environment, vehicle finance providers are continually challenged to adapt and embrace change.

Caption. Credit:

Navigating complexity with the right technology solution

But the right software solution can help navigate all this complexity and transform a business - opening up new revenue streams, and bringing heightened operational productivity.

Alfa Systems 6, 2024’s breakthrough iteration of the Alfa Systems software platform, delivers important changes in performance and function to help ensure auto finance providers tackle the significant challenges they face, and seize the lucrative opportunities that lie waiting - without needing to upgrade their infrastructure.

Delivering Alfa Systems 6 in a series of six releases, culminating in the full release in October 2024, Alfa continues to innovate and evolve, empowering automotive finance providers to do more business and secure the edge over their competition.

The Six Pillars of Alfa Systems 6

Release 1: Efficiency (Dec 2023)

One of the greatest operational challenges is around efficiency and achieving economies of scale.

Alfa Systems already equips auto finance providers with robust functionality that empowers them to replicate and automate their processes. This includes the ability to create customised fields, utilise manual and automated workflows incorporating a vast library of business rules, and leverage powerful integrations.

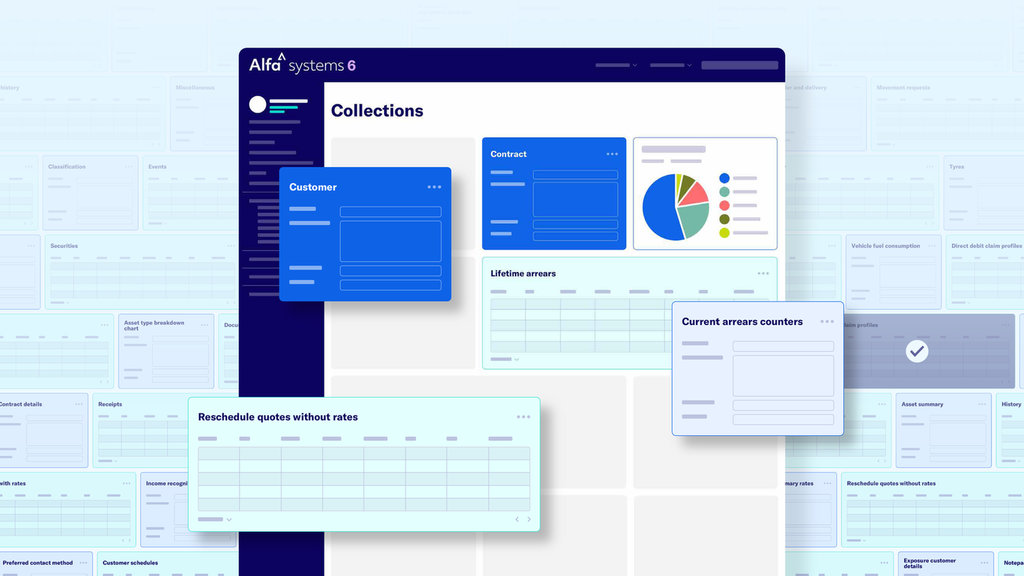

But the first Alfa Systems 6 release takes efficiency to the next level. It introduces Compose – an industry-first innovation that allows users to create any number of highly personalised enquiry screens, featuring only the information that is essential to the task at hand. Using a no-code, drag-and-drop interface, screens can be created in minutes and made available in real time with no redeployment or restart. This dramatically improves flow and reduces time, click count and cognitive load - at all points in a workflow, throughout the contract lifecycle and beyond.

Compose: Superpersonalised screen design

Release 2: Total Capability (Jan 2024)

In an age of data lakes and APIs, a provider's choice in deploying multiple systems has never been greater. However, carried out inefficiently - for example, leveraging distinct software platforms for different business lines or processes - can still attract significant cost and effort. This can be seen in pricing not synchronised between quoted and active contracts, extensive provider onboarding time and data mapping, plus intensified vulnerabilities, audit requirements, testing and other complexities within the interactions between API and system.

For auto finance providers undertaking a systems selection exercise, striking a balance between operational efficiency and richness of capability poses a challenge. Consolidating processes and business lines on a single platform like Alfa Systems 6 offers the complete ensemble of cost savings, efficiency gains and rich functional depth.

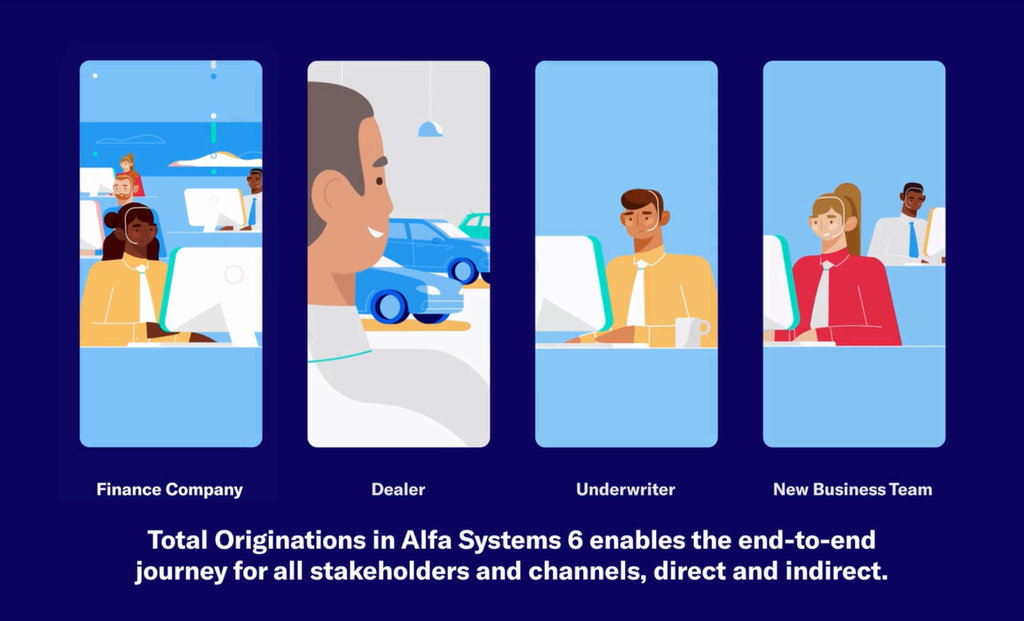

Total Originations in Alfa Systems 6

Alfa has responded to changing market requirements, as well as customer feedback, by expanding the functionality of its Originations product to be the premium solution to occupy a place at the heart of your business, allowing operation of a single system that incorporates powerful Originations, Servicing and Collections capabilities.

Total Capability in Alfa Systems 6 introduces Total Originations, covering direct and indirect lending, from quoting to funding, and representing an integrated part of the Alfa Systems platform – allowing motor finance providers to take advantage of Alfa Systems’ total capability.

At the heart of the auto finance industry

While those on the periphery offer little more than smoke and mirrors, at Alfa we pride ourselves on occupying a place at the heart of the industry.

Where others' offerings are set in stone, Alfa's absolute flexibility, and total understanding of the ways and needs of auto finance, mean that our product is constantly evolving; and our remit is not simply to listen, understand and deliver - but to be ready.

Contact information

Alfa

Moor Place

1 Fore Street Avenue

London EC2Y 9DT

Email: sales@alfasystems.com

Web: www.alfasystems.com