Cover story

Are EV leasing prices inflated?

A recent report looking at EV leasing prices and depreciation rates argues leasing prices are too high, sparking a robust response from the industry. We look at both sides of the argument. Chris Farnell reports.

Caption: While it is widely accepted that the leasing sector has an important role to play in bringing EVs to the mainstream, it is also well-known that leasing prices are much higher for BEVs than they are for equivalent ICE vehicles.

Credit: Shutterstock.com

There can be no denying the pivotal role that leasing companies have played in the introduction of electric vehicles (EVs) to the UK automotive market.

“Leasing has led the transition to electric vehicles. Without leasing companies acting early, trialling new technology, accepting the risk and getting vehicles on the road, we would be much further behind where we currently sit,” says Toby Poston, Director of Corporate Affairs for BVRLA. For a weary consumer, leasing provides a way for drivers to dip their toes in the water of EVs without being locked into a commitment they do not want.

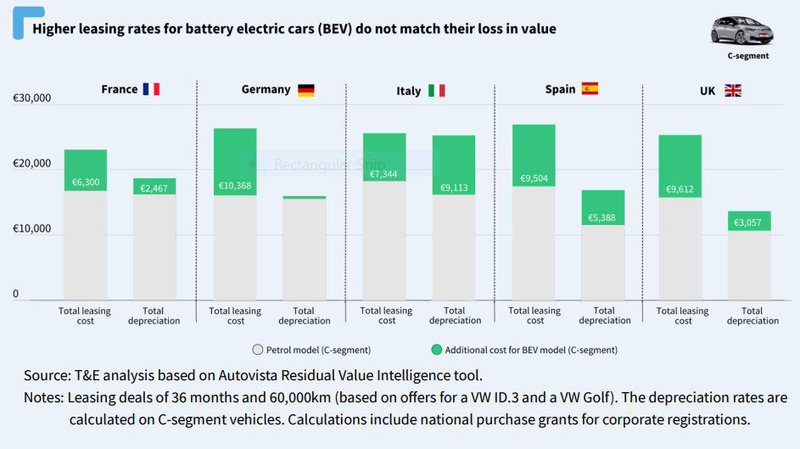

BEVs depreciate more, but not as much as the price difference between leases would suggest. The depreciation rate is 25% higher than it is for ICE vehicles, where the leasing price difference is 45%.

Griffin Carpenter, Company Cars Analyst at T&E

“With EV technology being only a decade old, many drivers who have yet to make the switch will have concerns around the longevity and reliability of the battery pack,” says Ian Plummer, Commercial Director of Auto Trader. “Because drivers never own the vehicle when it’s leased, the leasing channel offers a solution that ensures they’re not committed to the vehicle long term, and therefore responsible for having to maintain and repair the battery beyond the warranty period.”

As well as enabling company car fleets to go electric, leasing companies have used innovative new business models like salary sacrifice to help provide EV access to a whole new market of drivers.

“Non-traditional company car drivers are now able to transition to electric vehicles, including many basic rate taxpayers and public sector workers,” Poston points out.

But while it is widely acknowledged the leasing sector has an important role to play in bringing electric vehicles to the mainstream, it is also well-known that leasing prices are much higher for BEVs than they are for equivalent ICE vehicles. The recently published report, Used Electric Cars Are Hot, Leasing Deals Are Not from the European Federation for Transport and Environment, an NGO campaigning for cleaner transport, commonly referred to as Transport & Environment (T&E), has looked into this price difference to ask: Is it justified?

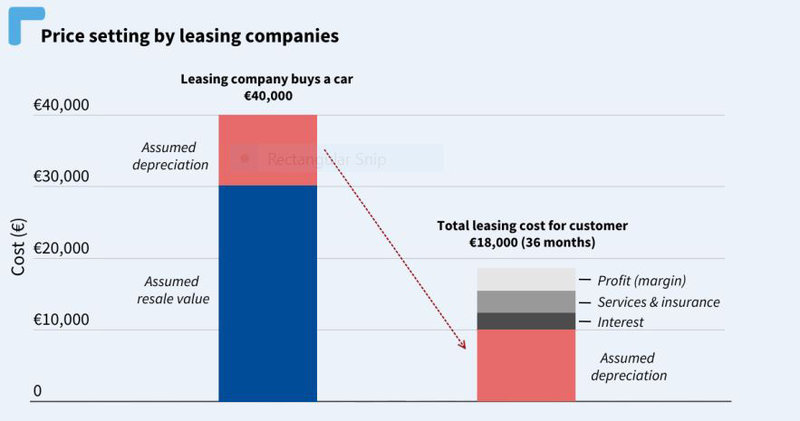

“You may say this is to be expected because they are more expensive to purchase. But first of all, the difference is even higher between leases than it is between the purchasing equivalents and also it is not purchase-price that matters, it is depreciation,” argues Griffin Carpenter, Company Cars Analyst at T&E and an author on the report. “What we see when we analyse the data is that historically there is a difference in depreciation. BEVs depreciate more, but not as much as the price difference between leases would suggest. The depreciation rate is 25% higher than it is for ICE vehicles, where the leasing price difference is 45%.”

Source: T&E, Used EVs Are Hot, Leasing Deals Are Not Report, February 2023

A matter of risk

One argument that justifies this price difference is risk. Customers lease, rather than buy, to avoid issues regarding fluctuations in value, as leased cars are returned to the leasing company at the end of term with no financial risk for the consumer.

“As the electric market is still in its infancy, and therefore still gaining confidence in the accuracy of residual value calculations, this will be of greater importance to electric vehicle consumers,” says Plummer.

But, the argument goes, absorbing that risk comes at a price.

Leasing companies are spending billions of pounds to absorb the risks of taking on these assets which are fundamentally allowing drivers to make the transition to an EV without taking on the risks themselves.

Ian Plummer, Commercial Director of Auto Trader

Plummer says, “Leasing companies are spending billions of pounds to absorb the risks of taking on these assets which are fundamentally allowing drivers to make the transition to an EV without taking on the risks themselves.”

Carpenter readily agrees that those risks are an issue but is not sure that the responses to those risks are proportionate.

“As I understand it, the explanation is clear – risk carries a premium,” Carpenters says. “Because there is uncertainty surrounding BEVs, that risk means there might be poor resale values. That leads to BEVs being priced higher and that makes sense for large leasing companies and banks where conservatism is in their DNA. We are only now getting volumes we can draw conclusions from.”

Plummer strongly disagrees with accusations of conservatism, however.

“We need to remember that EV technology is in its infancy which makes setting Residual Values (RV) for EVs more challenging, but not to the point that leasing companies are being over-conservative,” he says.

“The report from T&E was incorrect to suggest that leasing companies are keeping prices artificially high on EV lease agreements. When considering the risk profile of a BEV fleet, the pricing model being adopted is entirely justified,” Poston agrees. “That risk comes from the used market for electric vehicles being incredibly immature and volatile. There is also the fact that technology is improving at an incredible rate to create further competition between new and used EVs.”

Poston points to the example that three years ago the majority of BEVs on sale were premium models. Those models are now cycling into the used market, but face competition from newer, cheaper BEVs that benefit from rapid improvements in vehicle technology.

“The volatility of the used EV market is evident in how used BEV prices have fallen for seven months in a row since the height of last year,” Poston says. “With current high energy prices and no tax incentives, used buyers have very little encouragement to make the jump to electric.”

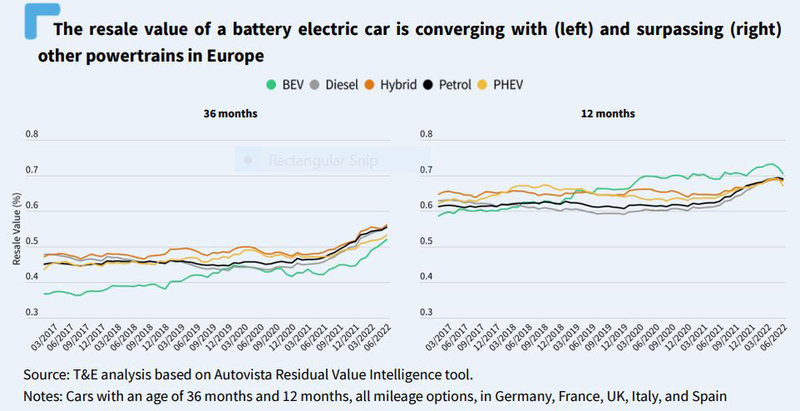

The T&E report explores several theories arguing why BEV resale prices might be higher or lower than their ICE counterparts, but Carpenter keeps coming back to the data.

“Our analysis serves as an empirical test for these theories by looking at actual market data,” he says. “The results show that BEV resale values are fairly high — especially in comparison to leasing offers — and thus lend support for theories that explain high BEV resale values.”

Auto Trader reports that used EV supply first overtook demand in November 2022. That gap has increased each month since, with stock levels increasing while demand stays relatively steady.

But Carpenter argues a longer-term perspective is necessary.

“The second-hand value of cars has dropped off a lot in the first months of 2023 for a number of reasons,” he insists. “TESLA reducing the price of new cars puts pressure on the second-hand market, and there is a market correction happening. The value of second-hand BEVs went off the charts in 2022, so this is taking things back to where they were at the beginning of 2022.”

The T&E report argues for judging trends over time. “We have graphs that go from 2017 to 2022 showing BEV resale values over that period, and that longer-term sense is the way to approach this rather than following month-to-month fluctuations,” Carpenter says.

Is leasing leading the way?

This report has received such a contentious response not just because it argues prices are inflated, but because it calls into question how effective the leasing sector is in leading the EV transition.

“Whilst the report calls out leasing companies for not having fixed electrification targets, fundamentally the Government 2030 deadline for banning the sales of new petrol and diesel cars, is the target each and every leasing company in the UK has to work towards, with no room for compromise based on the nature of their business,” Plummer argues.

When considering the risk profile of a BEV fleet, the pricing model being adopted is entirely justified.

Toby Poston, Director of Corporate Affairs for BVRLA.

“The T&E report overlooked how proactive the leasing sector has been to date, and the positive steps being taken to help more drivers make the switch to EVs,” Poston adds.

Plummer argues that the price difference is due to EVs having a higher starting list price when depreciating to the same per cent of the list price. This means many EV residual values are set higher in terms of value than their ICE equivalents, which is passed on when that value is converted to a monthly leasing payment. A £20,000 ICE vehicle depreciating 60% to £8,000 will reflect £12,000 of depreciation in the monthly rentals (£333 per month on 36 monthly rentals). A £30,000 EV vehicle depreciating the same 60% to £12,000 will reflect £18,000 of depreciation in the monthly rentals (£500 per month on 36 monthly rentals).

But Carpenter argues that the price of the car is irrelevant to his report’s analysis.

“It is the depreciation of the car that should be compared,” he says. “What is the assumed depreciation and what is the actual depreciation of the vehicle? If the assumed depreciation was a difference of 40 or 45%, what was the reality? And the answer is it was more like 20 to 25%.”

Plummer argues that leasing companies are being expected to give unreasonable special treatment to EV leases.

“To expect leasing companies to approach depreciation and risk mitigation differently, say a fixed value depreciation, with the unknowns that come with funding relatively new technology is unreasonable,” Plummer says. “Leasing companies aren’t working from the plethora of historical data that exists for petrol and diesel model to demonstrate EVs will depreciate any differently to existing per cent models.”

“Comparing EVs vs ICE is not like-for-like. The EV market is unpredictable. The technology is developing at an incredible rate, essentially giving us months of data to work from,” says Poston. “On the other hand, the new and used ICE vehicle markets have years, decades of input to give a consistent, clear picture.”

Carpenter, however, believes we are now in precisely the position to start judging these assumptions.

“We can now look at how those predictions have performed in the past,” he says. “What I hope is that it has kicked off some conversation and ruffled a few feathers. This data can be compared with other internal data within leasing companies to see if that conservatism is justified. I think we are at a point now where we can analyse what has happened in the past and test those assumptions.”

However, Plummer insists that longevity is not the same as quantity.

“It’s less about the number of years and more about the actual volume of data,” Plummer says. “In 2017, EVs made up 0.13% of the UK car park, in 2022 this was 2.9%. The industry is only just beginning to accrue enough data to be able to make informed decisions on RVs.”

But Carpenter remains sceptical.

“For the past several years we’ve heard that it’s still too early to assess the used BEV market,” he says. “But as the number of second-hand BEVs in Europe has climbed from the thousands to the tens of thousands to the hundreds of thousands, it seems like maybe the problem isn’t the number of BEVs to assess, but a more fundamental conservatism in the industry and a reluctance to ask difficult questions.”

Source: T&E, Used EVs Are Hot, Leasing Deals Are Not Report, February 2023

Local issues

As well as disagreeing over the risks the industry should be taking on, and the quality of the data available, the UK market, in particular, faces unique challenges, some argue, the Europe-based report has not addressed.

“The report also underplayed the specific nuances of the UK market. Supported by a fair tax regime, the leasing sector has driven the growth of the company car and salary sacrifice markets,” says Poston.

He also points out, “The UK also faces a unique situation compared to the rest of Europe by being a right-hand drive market. This places greater risk on vehicles entering the used market, as any oversupply cannot be flattened by exported to other markets when demand exists.”

Carpenter also readily agrees with these points but believes the place to price these in is the second-hand market.

“There are indeed incentives, in particular benefit-in-kind, but that should be priced into second-hand sales, especially in the UK which is an isolated car market with Ireland for left-hand drive,” he says. “I don’t think leasing companies do or should take unwarranted risks on BEVs.”

We are also living through eventful times, and Plummer points to several wider-context issues affecting the market right now, from a volatile automotive market that has yet to stabilise to pre-Covid levels, to the war in Ukraine that has contributed to significant supply chain issues for vehicle manufacturers, a lack of new car production since the pandemic, and an ongoing cost-of-living crisis.

“ICE vehicles are in general quicker to build due to fewer semi-conductors used in the manufacturing process,” Plummer points out.

“EVs are also reliant on a national infrastructure that is still developing,” Poston says. “The success of EVs is dependent on drivers having confidence in the UK’s EV charging infrastructure.”

The way forward

While Carpenter and the Transport & Environment report point to perceived issues highlighted by the data available, Carpenter is hesitant to suggest solutions.

“I am not in that industry and do not pretend I have an understanding of all their pricing dynamics,” he says. “I can only analyse data from millions of different car sales, and it seems to me there is this conservatism built in, and because of that drivers have been overcharged.”

In the industry, however, there are suggestions as to what would be needed to bring leasing prices down.

“Certainty in the used market. Without that, each transaction carries more risk and companies are unable to plan with confidence,” Poston says. “The BVRLA is undertaking work with government departments and data providers to better understand and communicate the factors that impact the market.”

He points to pressure points, such as the VAT difference on electricity delivered at home (5%) or at public charge points (20%) that could ensure all EV drivers benefit from reduced running costs.

Ultimately, however, despite Carpenter’s arguments around depreciation, it all comes down to price.

“Fundamentally, whether it’s leasing or buying an EV outright, there needs to be price parity between electric and combustion engine models,” Plummer insists.

“Above everything else, list prices have the biggest impact on leasing prices,” Poston agrees. “Only by list prices coming down on EVs can the gap between them and equivalent ICE vehicles be closed.”

But while the volatility of the market is widely remarked upon, its outlook is positive according to The Supply & Demand Outlook and Its Impact on Residual Values from Fleet Europe. Talking about EVs, Emmanuel Labi, CEO of Autobiz says “Overall, RVs will remain fairly stable. Even if, in some countries, the domestic supply of used EVs is limited, as is the case in Germany or Italy.”

Source: T&E, Used EVs Are Hot, Leasing Deals Are Not Report, February 2023

The report says that even Tesla’s dramatic price reduction has failed to significantly impact the RV of used Teslas.

“In countries like the Netherlands and Portugal, with a high level of EV maturity and penetration, RVs for EVs are high,” Labi says in the report. “In countries with a fairly good level of EV maturity, the RVs are stable. And in countries that are not as mature in terms of EVs, including Germany and Italy, we see that residual values of EVs are subject to a rollercoaster.”

Rick Zielman, Partnership Director for Autotelex adds, “In the long term, BEVs will definitely have higher RVs than ICEs.”

However, the argument over residual values and leasing prices plays out, the crucial role of leasing in the move to EVs remains.

“Put simply, leasing is the most affordable way of getting into a new EV right now and, as such, plays a vital role in the mass adoption of EVs in the UK ahead of the 2030 deadline,” says Plummer. “As electric costs come down, the overall cost of leasing an EV may end up being just as affordable as ICE.”