INSIGHT

Databank – April 2021

The latest data from around the automotive industry

Motor Finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Jan-21 | % change on prev. year | 3 months to Jan 2021 | % change on prev. year | 12 months to Jan 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 850 | -31 | 2,995 | -24 | 15,116 | -23 |

| Number of cars | 36,134 | -38 | 127,190 | -28 | 674,728 | -27 |

| Used cars | ||||||

| Value of advances (£m) | 1,142 | -31 | 3,396 | -20 | 15,597 | -16 |

| Number of cars | 87,557 | -34 | 256,667 | -23 | 1,193,710 | -20 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Jan-21 | % change on prev. year | 3 months to Jan 2021 | % change on prev. year | 12 months to Jan 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 21,542 | -19 | 72,616 | -16 | 258,883 | -39 |

| Used cars | ||||||

| Number of cars | 3,530 | -56 | 11,951 | -18 | 55,654 | 9 |

Analysis

Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said:“The impact of the latest UK-wide lockdown restrictions has not been as severe as the first lockdown introduced last March with many dealerships able to offer click and collect or deliver services. The value of new business in the consumer car finance market is expected to fall by 16% in Q1 2021 as a whole.

“Our latest research suggests that once showrooms re-open there will be a strong recovery in the consumer car finance market, with the value of new business expected to grow by 17% in 2021, and a further 12% growth forecast for 2022.”

Motor Industry statistics (SMMT)

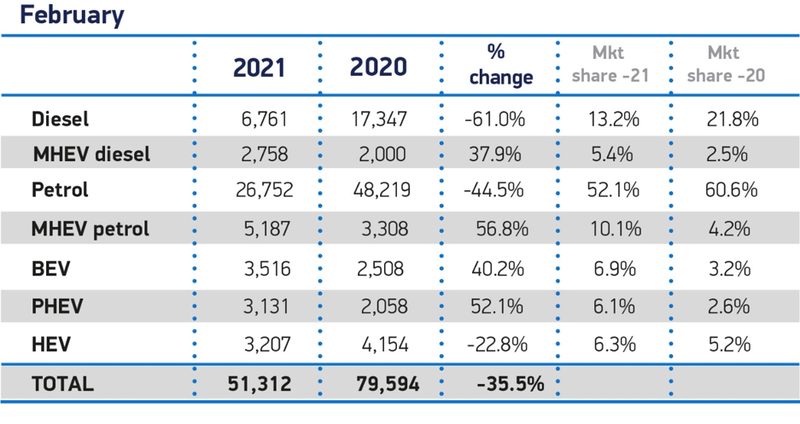

New car registration by vehicle type

Analysis

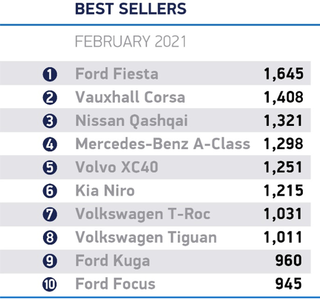

Mike Hawes, SMMT Chief Executive, said: “February is traditionally a small month for car registrations and with showrooms closed for the duration, the decline is deeply disappointing but expected. More concerning, however, is that these closures have stifled dealers’ preparations for March with the expectation that this will now be a third successive dismal ‘new plate month’.

“Although we have a pathway out of restrictions with rapid vaccine rollout, and proven experience in operating click and collect, it is essential that showrooms reopen as soon as possible so the industry can start to build back better, and recover the £23 billion loss from the past year.”

Europe Focus (ACEA)

| Feb-21 | Feb-20 | %Change 21/20 | Jan-Jan 2021 | Jan-Feb 2020 | %Change 21/20 | |

| France | 132,637 | 167,782 | -20.9 | 259,017 | 302,011 | -14.2 |

| Germany | 194,349 | 239,943 | -19.0 | 364,103 | 486,243 | -25.1 |

| Italy | 142,998 | 163,124 | -12.3 | 277,145 | 318,991 | -13.1 |

| Spain | 58,279 | 94,618 | -38.4 | 100,242 | 181,060 | -44.6 |

| United Kingdom | 51,312 | 79,594 | -35.5 | 141,561 | 228,873 | -38.1 |

| Total (EU + EFTA + UK) | 850,170 | 1,066,172 | -20.3 | 1,693,059 | 2,200,957 | -23.1 |

Analysis

In February 2021, new passenger car registrations in the European Union dropped by 19.3%, as COVID containment measures and uncertainty continue to weigh heavily on demand. With 771,486 units registered across the EU region, this marked the lowest February total on record since 2013. All four major EU markets recorded losses last month. Italy posted the smallest drop (-12.3%), while the other markets faced stronger declines: Germany (-19.0%), France (-20.9%) and Spain (-38.4%).

From January to February 2021, total registrations of new cars in the European Union were 21.7% lower than during the same period in 2020. So far this year, demand fell in each of the major markets. Spain was the hardest hit, with sales almost halved (-44.6%) compared to last year, followed by Germany (-25.1%), France (-14.2%) and Italy (-13.1%).