Caption. Image:

Pricing

'Leasing companies are overcharging drivers for EVs'

According to Transport & Environment, a non-profit group, leasing deals in the used car market for battery electric vehicles are overpriced.

Leasing companies are harming the transition to electric cars through their high pricing and weak zero-emission targets, a study by Transport & Environment (T&E) has found.

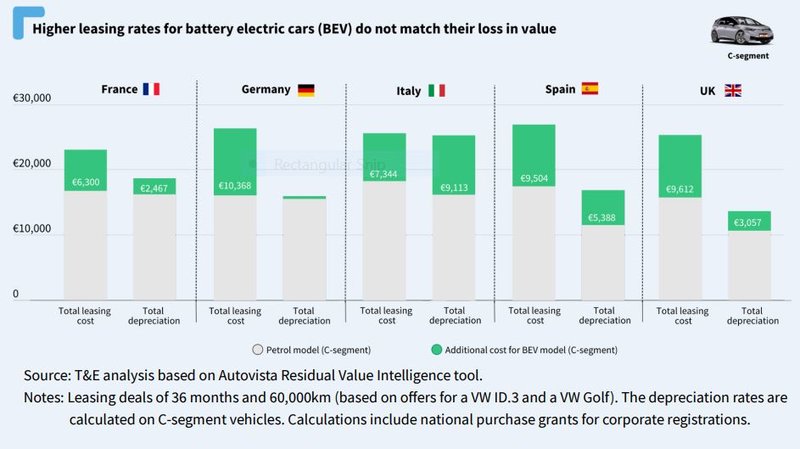

Leasing deals for battery electric vehicles (BEVs) are overpriced, an analysis by T&E of the used car market has found.

In Europe, leasing deals for BEVs are, on average, 57% more expensive than their equivalent petrol models. For example, leasing an electric Peugeot 208 costs approximately €574 a month, whilst the petrol Peugeot 208 is €371.

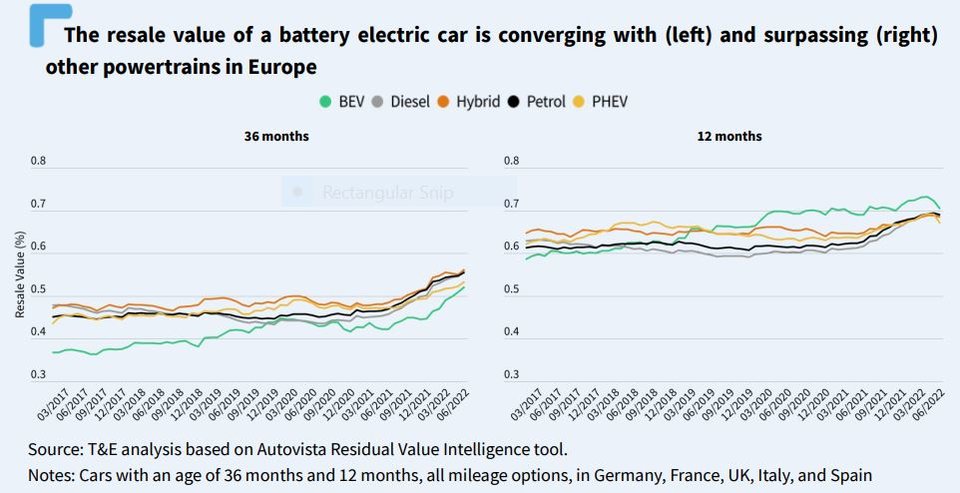

However, according to T&E analysis, BEVs have similar resale value to diesel and petrol vehicles.

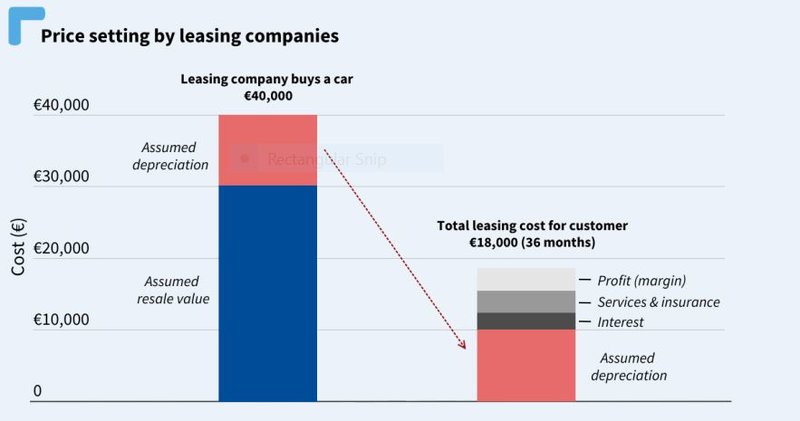

Leasing companies typically charge customers for the expected loss in value of a vehicle over a three to four-year lease, so higher lease prices mean they expect BEVs to lose more of their value. But this is no longer the case.

The higher leasing prices for battery electric cars are unjustified. T&E analysis of 2.7 million used car prices has revealed that BEVs do not depreciate more steeply than other types of cars. Depreciation for BEVs in Europe’s biggest markets (Germany, France and the UK) is on par with diesel and petrol. In Spain, there is still a difference, but the gap is closing.

The study found that BEVs keep more of their value over time, reflecting consumer confidence in newer models with improved technology. Consumer demand for BEVs, new and used, is at an all-time high.

Stef Cornelis, director of electric fleets at T&E, said: “Today, customers are being overcharged by leasing companies if they want to switch to a battery electric car. Leasing firms are too conservative when setting their monthly prices. Their rates reflect the state of play from five years ago. With this pricing strategy, their profits are obviously high and consumers are overpaying to go electric. At the same time, they are harming the BEV transition.”

Leasing companies – with a fleet of 12 million vehicles in Europe – have an outsized role to play in the transition to battery electric cars.

In 2022, they accounted for 22% of new car registrations in Europe, the study found. Leasing companies are often owned by banks and car manufacturers, such as Lloyds Bank (Lex Autolease), Société Générale (ALD), BNP Paribas (Arval), Volkswagen (VW Financial Services), and Mercedes-Benz (Athlon).

EV targets?

None of these leasing companies has a target to become fully battery-electric by 2030. The ‘EV’ targets they have set are weak and include plug-in hybrids (PHEVs) – whose CO2 emissions are on par with petrol and diesel cars. Their commitments are far behind market dynamics as large carmakers have already committed to 100% battery electric by 2030.

As a result, the leasing sector is not leading on the BEV transition. The study found that in France and Spain, BEV uptake in the leasing sector was lower than in other corporate fleets and even private households. The UK stands out as an exception where the leasing sector is leading the BEV transition with a BEV uptake of 34%.

Cornelis concludes: “These giants of the auto world have gone unnoticed and are slipping through the cracks. Looking at their weak targets for BEVs, leasing companies are climate laggards and not green leaders.

“Unless they rapidly accelerate their electrification plans, we will struggle to supply a second-hand market that will make BEVs affordable to far more people and we further delay the decarbonisation of the transport sector.”

T&E is a non-profit organisation that receives funding from the Climate Imperative Foundation, The European Climate Foundation, Schwab Charitable Fund, the European Commission, Quadrature Climate Foundation, and the Norwegian Agency for Development Cooperation, amongst other organisations.

Reaction

BVRLA director of corporate affairs Toby Poston said: “Vehicle leasing companies have led the charge in bringing battery electric vehicles to market. The accusations levelled by Transport and Environment show little understanding of how this market operates.

“Like a toddler taking its first steps, the BEV market still needs support in the form of tax incentives, grants and marketing campaigns that give fleets and drivers the encouragement they need to make the leap.

“This support disappears when it comes to selling the same vehicle on the second-hand market. The lease companies that have invested billions in untried, untested BEV technology are navigating this ocean without a map, compass or weather gauge.

“The current market has seen five consecutive months of falling prices and a growing imbalance between vehicle stock and prospective buyers.

“Despite these market conditions, BVRLA members continue to buy new electric vehicles in record volumes. They are absorbing the financial risks of a turbulent used market on behalf of their customers.

“Transport and Environment’s research would be better focused on making the case for more government support on public charging infrastructure and other measures that will benefit the used BEV market.”

Auto Trader commercial director Ian Plummer, said: “This report shows little understanding of how residual values are calculated and how the automotive industry functions whilst ignoring the context of a maturing market where lenders can’t rely on abundant historical datasets to make decisions about new products.

“We believe this is a case of financial institutions simply having to base calculations on the limited data available to them in an emerging market, rather than any deliberate attempt to unfairly increase profits at the expense of the consumer.”