INSIGHT

Databank – September 2021

The latest data from around the automotive industry

Motor finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Aug-21 | % change on prev. year | 3 months to Aug 2021 | % change on prev. year | 12 months to Aug 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 906 | -13 | 4,132 | 0 | 17,811 | 12 |

| Number of cars | 40,018 | -18 | 179,499 | -4 | 762,683 | 5 |

| Used cars | ||||||

| Value of advances (£m) | 1,683 | 0 | 5,158 | -2 | 18,388 | 13 |

| Number of cars | 119,491 | -7 | 369,627 | -8 | 1,366,243 | 8 |

| Total cars | ||||||

| Value of advances (£m) | 2,589 | -5 | 9,290 | -1 | 36,199 | 13 |

| Number of cars | 159,509 | -10 | 549,126 | -6 | 2,128,926 | 7 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Aug-21 | % change on prev. year | 3 months to Aug 2021 | % change on prev. year | 12 months to Aug 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 20,778 | 2 | 79,538 | 34 | 322,063 | 14 |

| Used cars | ||||||

| Number of cars | 3,049 | -20 | 10,878 | -15 | 51,563 | -6 |

Analysis: Geraldine Kilkelly, director of research and chief economist at the FLA

Supply issues in the new car market caused by the shortage of semi-conductors continue to hamper the recovery of the automotive industry following the pandemic. New business volumes in the consumer new car finance market fell for a second consecutive month in August and the near-term outlook is likely to be weaker than previously expected.

By contrast, the consumer used car finance market remains relatively strong, with annual new business by value in August only 1% below its pre-pandemic peak.

Motor industry statistics (SMMT)

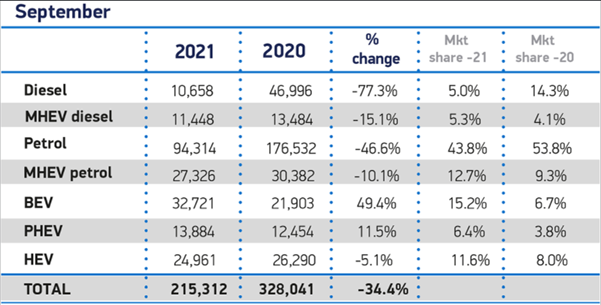

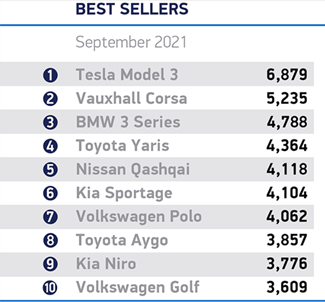

New car registration by vehicle type

Analysis: Mike Hawes, chief executive at the SMMT

This is a desperately disappointing September and further evidence of the ongoing impact of the Covid pandemic on the sector. Despite strong demand for new vehicles over the summer, three successive months have been hit by stalled supply due to reduced semiconductor availability, especially from Asia. Nevertheless, manufacturers are taking every measure possible to maintain deliveries and customers can expect attractive offers on a range of new vehicles.

Despite these challenges, the rocketing uptake of plug-in vehicles, especially battery electric cars, demonstrates the increasing demand for these new technologies. However, to meet our collective decarbonisation ambitions, we need to ensure all drivers can make the switch – not just those with private driveways – requiring a massive investment in public recharging infrastructure. Chargepoint roll-out must keep pace with the acceleration in plug-in vehicle registrations.

Europe focus (ACEA)

| Sep-21 | Sep-20 | %Change 21/20 | Jan-Sep 2021 | Jan-Sep 2020 | %Change 21/20 | |

| France | 133,830 | 168,289 | -20.5 | 1,260,373 | 1,166,698 | +8.0 |

| Germany | 196,972 | 265,227 | -25.7 | 2,017,561 | 2,041,831 | -1.2 |

| Italy | 105,175 | 156,357 | -32.7 | 1,165,491 | 966,335 | +20.6 |

| Spain | 59,641 | 70,278 | -15.7 | 647,955 | 595,436 | +8.8 |

| United Kingdom | 215,312 | 328,041 | -34.4 | 1,316,614 | 1,243,656 | +5.9 |

| Total (EU + EFTA + UK) | 886,970 | 1,198,565 | -26.0 | 8,247,019 | 7,745,070 | +6.5 |

Analysis

EU passenger car registrations continued their decline in September 2021. Demand in the region shrank by 23.1% to 718,598 units, marking the lowest number of registrations for a September since 1995. This decrease in sales was largely caused by a lack of supply of vehicles due to the ongoing semiconductor shortage.

Over the first three quarters of 2021, car registrations across the EU climbed 6.6% to reach 7.5 million units, as significant gains earlier in the year helped to keep cumulative volumes in positive territory.

Looking at the largest EU markets, Italy posted the highest increase so far (+20.6%), followed by Spain (+8.8%) and France (+8.0%). By contrast, the German car market slipped back into negative territory (-1.2%).