INSIGHT

Databank – May 2021

The latest data from around the automotive industry

Motor Finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Mar-21 | % change on prev. year | 3 months to Mar 2021 | % change on prev. year | 12 months to Mar 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 2,709 | 9 | 4,233 | -9 | 15,118 | -19 |

| Number of cars | 110,804 | -2 | 176,928 | -18 | 657,765 | -25 |

| Used cars | ||||||

| Value of advances (£m) | 1,662 | 32 | 4,032 | -11 | 15,621 | -14 |

| Number of cars | 123,261 | 24 | 303,601 | -15 | 1,184,509 | -19 |

| Total cars | ||||||

| Value of advances (£m) | 4,371 | 17 | 8,265 | -10 | 30,739 | -17 |

| Number of cars | 234,065 | 10 | 480,529 | -16 | 1,842,274 | -21 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Mar-21 | % change on prev. year | 3 months to Mar 2021 | % change on prev. year | 12 months to Mar 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 34,748 | 12 | 72,680 | -8 | 257,954 | -36 |

| Used cars | ||||||

| Number of cars | 4,665 | 1 | 11,635 | -28 | 55,543 | 4 |

Analysis

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “In March, the consumer car finance market reported growth for the first time in six months, with used car finance new business volumes growing at their fastest rate for seven years.

“A year on since the introduction of the first restrictions to deal with the pandemic, the market and wider economy continue to be impacted by ongoing restrictions. However, the latest set of figures show that the industry has adapted to meet the challenges posed by the crisis.”

Motor Industry statistics (SMMT)

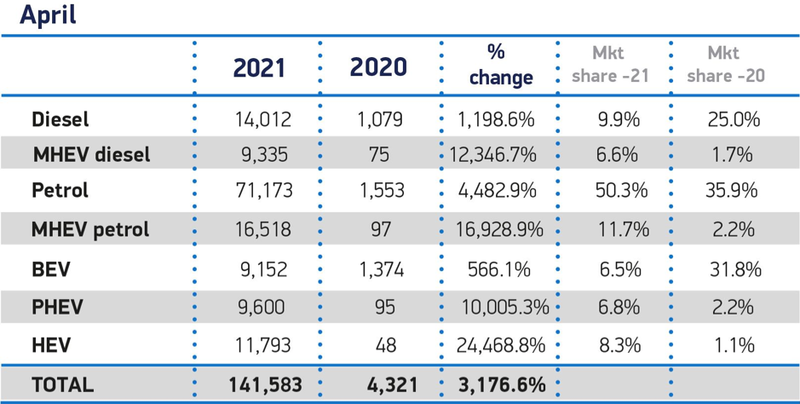

New car registration by vehicle type

Analysis

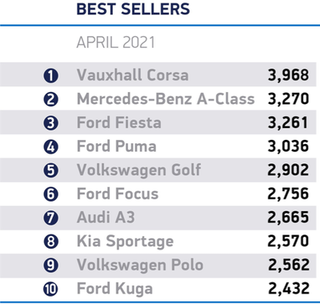

Mike Hawes, SMMT chief executive, said: “After one of the darkest years in automotive history, there is light at the end of the tunnel. A full recovery for the sector is still some way off, but with showrooms open and consumers able to test drive the latest, cleanest models, the industry can begin to rebuild.

“Market confidence is improving, and we now expect to finish the year in a slightly better position than anticipated in February, largely thanks to the more upbeat business and consumer confidence created by the successful vaccine rollout. That confidence should also translate into another record year for electric vehicles, which will likely account for more than one in seven new car registrations.”

Europe Focus (ACEA)

| Apr-21 | Apr-20 | %Change 21/20 | Jan-Apr 2021 | Jan-Feb 2020 | %Change 21/20 | |

| France | 140,426 | 20,997 | +568.8 | 582,217 | 385,676 | +51.0 |

| Germany | 229,650 | 20,997 | +90.0 | 582,217 | 822,202 | +7.8 |

| Italy | 145,033 | 4,295 | +3,276.8 | 592,181 | 351,703 | +68.4 |

| Spain | 78,595 | 4,163 | +1,787.9 | 264,655 | 222,866 | +18.8 |

| United Kingdom | 141,583 | 4,321 | +3,176.6 | 567,108 | 487,878 | +16.2 |

| Total (EU + EFTA + UK) | 1,039,810 | 292,153 | +255.9 | 4,120,443 | 3,346,010 | +23.1 |

Analysis

In April 2021, new car registrations surged by 218.6% in the European Union because of last year’s low base of comparison due to coronavirus restrictions. Indeed, despite this big percentage increase, last month’s sales volume was almost 300,000 units lower than that recorded in April 2019.

Many markets across the EU region posted double- or even triple-digit percentage gains in April. Italy recorded the biggest uplift (+3,276.8%) of the major markets, followed by Spain (+1,787.9%). France (+568.8%) and Germany (+90.0%) also showed strong gains compared to last year.