ELECTRIC

2020: how leasing helped deliver the EV tipping point

Despite the huge challenges that 2020 presented to everyone in the global automotive industry, last year did represent a tipping point towards the future for our sector. Paul Harrison, head of strategic partnerships at Leasing.com, writes

T

he transition from internal combustion engines to battery-powered vehicles gained record momentum last year. SMMT data showed that 2020 was the best-ever year for new battery-electric vehicles (BEVs), with a total of 108,205 sales.

This sales volume gave BEVs a 6.6% share of the total new car market, compared to just 1.6% in 2019.

As the UK’s biggest leasing comparison website, Leasing.com has a huge amount of data and insight at our disposal and we saw even greater demand for BEVs last year than was seen in the SMMT data.

Demand for BEVs on Leasing.com – represented as total sales enquiry volumes – increased by 129% in 2020 compared to the previous year. Last year, BEVs accounted for 10.4% of total annual enquiries compared to 4% in 2019.

While we saw increased business demand for BEVs from April 2020 due to the Benefit-In-Kind tax incentives introduced for electric vehicles, nearly two-thirds of total BEV demand came from private individuals and cash allowance users. The BEV models and leasing profiles chosen by private and business users were also distinctly different in 2020, as our analysis shows.

Personal BEV trends

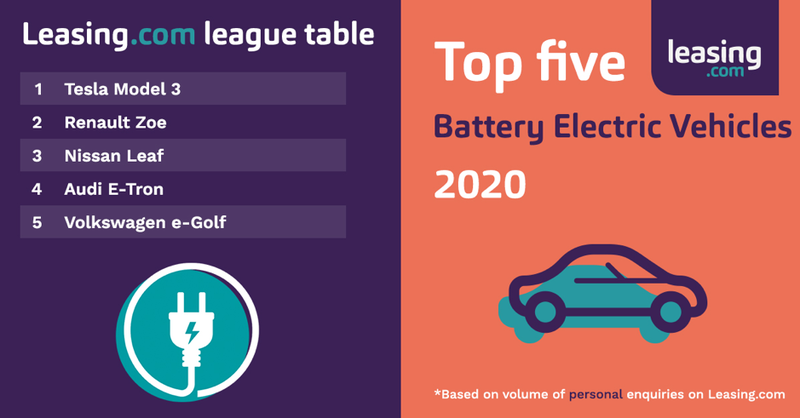

Leasing.com league table. Credit: Leasing.com

The Tesla Model 3 continues to set the standard by which many other BEVs are measured and this is reflected in its status as the most enquired about BEV by consumers. The Model 3 is followed by the highly-thought-of Renault Zoe and Nissan Leaf, which combine affordability with the latest BEV technology.

The Volkswagen Group rounds out the top five consumer BEVs in 2020 with the successful Audi E-Tron in fourth place, followed by the Volkswagen e-Golf, which has recently been replaced by the new ID.3.

The list of accessible brands that make up the top five BEVs to personal lease is reflected in the monthly rental that consumers wish to pay. A monthly rental of between £201-300 per month was by far the most frequently enquired about BEV payment last year.

In terms of profile of lease agreement, the largest proportion of consumers opted for a two-year term with nine upfront initial payments. Consumer preference for shorter 2-3 year lease agreements is consistent with the general trend seen across our marketplace.

Most consumers were looking for an annual mileage allowance of either 8,000 or 10,000 to accompany their lease, but we also saw a surge in demand for 5,000 mileage allowances in 2020 compared to 2019. Likely a result of us all driving far fewer miles during the pandemic.

“If 2020 was the tipping point for BEVs, then 2021 will see their continued drive into the mainstream market.”

Business BEV trends

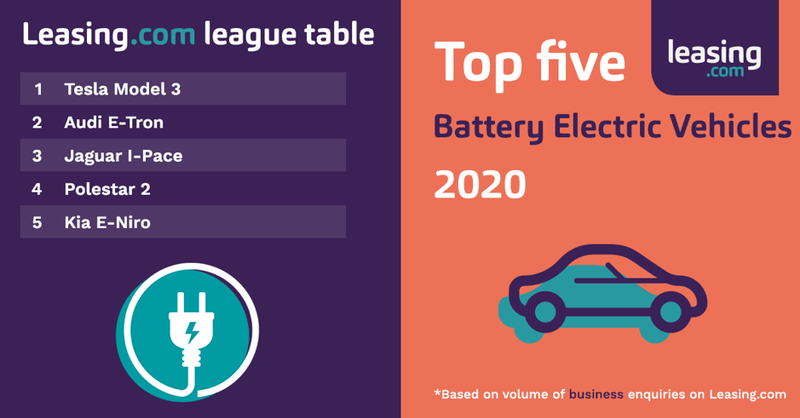

Leasing.com league table. Credit: Leasing.com

The top five business leasing BEVs consisted of different manufacturers and models compared to the consumer market. While the Tesla Model 3 retained its top spot, the Audi E-Tron was the second most popular model, followed by the Jaguar I-Pace. Polestar and Kia made an appearance with their 2 and E-Niro models, respectively.

Reflecting the premium specification of the business top five, business users most frequently requested a BEV leasing rental of between £401-500 per month. And to counter the higher monthly rentals, business users requested three-year terms on their BEVs rather than the two-year terms commonly seen in the consumer market. As expected, business mileage requirements were also higher than in the consumer market, with business BEV users looking for an annual mileage allowance of 10,000 or 15,000 miles.

Expectations for 2021?

If 2020 was the tipping point for BEVs, then 2021 will see their continued drive into the mainstream market. Demand for van BEVs should also start to follow the lead of cars and see a surge in interest in 2021.

With all eyes on the Government’s 2030 target to phase out the sale of pure internal-combustion engines, manufacturers are releasing an array of exciting new BEV models, which offer consumers and businesses ever greater choice and the ability to find a vehicle to meet their precise needs.

The SMMT is currently forecasting BEVs to account for nearly 12% in 2021, but here at Leasing.com we are forecasting BEV demand to exceed 20% of total enquiries this year.

Paul Harrison, Head of strategic partnerships at Leasing.com