INSIGHT

Databank – June 2021

The latest data from around the automotive industry

Motor Finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Apr-21 | % change on prev. year | 3 months to Apr 2021 | % change on prev. year | 12 months to Apr 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 1,382 | 2370 | 4,758 | 38 | 16,444 | -4 |

| Number of cars | 58,195 | 2195 | 198,583 | 24 | 713,424 | -11 |

| Used cars | ||||||

| Value of advances (£m) | 1,680 | 1204 | 4,580 | 53 | 17,172 | 3 |

| Number of cars | 125,821 | 1061 | 342,559 | 45 | 1,299,494 | -3 |

| Total cars | ||||||

| Value of advances (£m) | 3,061 | 1557 | 9,338 | 45 | 33,615 | -1 |

| Number of cars | 184,016 | 1276 | 541,182 | 37 | 2,012,918 | -6 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Apr-21 | % change on prev. year | 3 months to Apr 2021 | % change on prev. year | 12 months to Apr 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 31,032 | 147 | 82,280 | 27 | 276,691 | -25 |

| Used cars | ||||||

| Number of cars | 5,355 | -38 | 13,402 | -21 | 52,246 | -11 |

Analysis

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The consumer car finance market received a boost in April as showrooms re-opened, with the significant growth rate also reflecting the all-time low level of new business recorded in April 2020 at the start of the first lockdown.

“Pent-up demand and an improvement in consumer confidence are expected to contribute to a strong recovery during the second half of 2021, with our latest research suggesting that consumer car finance new business by value will grow by 19% in 2021 as a whole, and by a further 13% in 2022.”

Motor Industry statistics (SMMT)

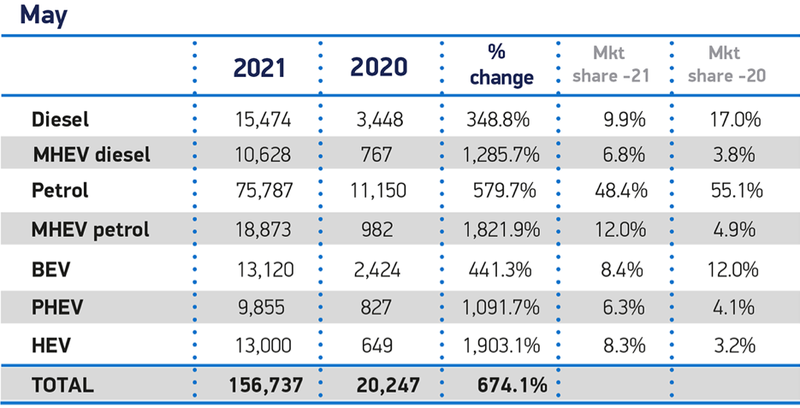

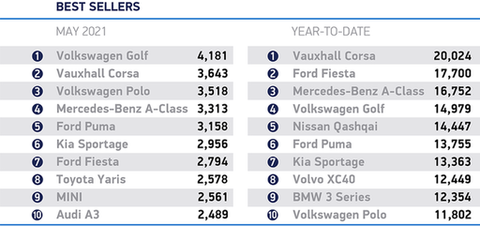

New car registration by vehicle type

Analysis

Mike Hawes, SMMT chief executive, said: “With dealerships back open and a brighter, sunnier, economic outlook, May’s registrations are as good as could reasonably be expected. Increased business confidence is driving the recovery, something that needs to be maintained and translated in private consumer demand as the economy emerges from pandemic support measures.

“Demand for electrified vehicles is helping encourage people into showrooms, but for these technologies to surpass their fossil-fuelled equivalents, a long term strategy for market transition and infrastructure investment is required.”

Europe Focus (ACEA)

| May-21 | May-20 | %Change 21/20 | Jan-May 2021 | Jan-May 2020 | %Change 21/20 | |

| France | 141,040 | 96,308 | +46.4 | 723,257 | 481,984 | +50.1 |

| Germany | 230,635 | 168,148 | +37.2 | 1,116,737 | 990,350 | +12.8 |

| Italy | 142,730 | 99,842 | +43.0 | 735,125 | 451,545 | +62.8 |

| Spain | 95,403 | 34,338 | +177.8 | 360,057 | 257,204 | +40.0 |

| United Kingdom | 156,737 | 20,247 | +674.1 | 723,845 | 508,125 | +42.5 |

| Total (EU + EFTA + UK) | 1,083,795 | 623,836 | +73.7 | 5,204,398 | 3,969,841 | +31.1 |

Analysis

In May 2021, passenger car registrations in the European Union rose by 53.4% compared to last year, totalling 891,665 units. Nevertheless, last month’s result is still far below the 1.2 million cars that were sold in May 2019.

From January to May 2021, EU demand for new cars increased by 29.5% to reach 4.3m units registered in total. The steep declines in the first two months of 2021 were counterbalanced by rises in March, April and May. Each of the four major markets posted double-digit percentage increases so far this year: Italy (+62.8%), France (+50.1%), Spain (+40.0%) and Germany (+12.8%).