INSIGHT

Databank – July / August 2021

The latest data from around the automotive industry

Motor Finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | May-21 | % change on prev. year | 3 months to May 2021 | % change on prev. year | 12 months to May 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 1,578 | 555 | 5,690 | 104 | 17,802 | 13 |

| Number of cars | 65,635 | 514 | 235,609 | 86 | 769,339 | 5 |

| Used cars | ||||||

| Value of advances (£m) | 1,747 | 293 | 5,105 | 179 | 18,490 | 19 |

| Number of cars | 130,899 | 270 | 380,972 | 161 | 1,396,044 | 12 |

| Total cars | ||||||

| Value of advances (£m) | 3,325 | 385 | 10,795 | 134 | 36,292 | 16 |

| Number of cars | 196,534 | 327 | 616,581 | 126 | 2,165,383 | 9 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | May-21 | % change on prev. year | 3 months to May 2021 | % change on prev. year | 12 months to May 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 26,882 | 363 | 93,140 | 89 | 298,001 | -11 |

| Used cars | ||||||

| Number of cars | 3,632 | 43 | 13,675 | -14 | 53,368 | -6 |

Analysis

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The recovery in the consumer car finance market continued in May as consumers have become more optimistic of a strong economic recovery. The significant growth rates reported in April and May reflect the impact on new business levels of restrictions to deal with Covid-19 during the first lockdown and we expect these to moderate in the coming months.

“Risks to the recovery remain from ongoing restrictions that may be needed to deal with the pandemic, the impact on confidence and unemployment once Government support schemes end, and increasing inflationary pressures. Nevertheless, we currently expect the industry to return to more normal new business levels during the second half of 2021.”

Motor Industry statistics (SMMT)

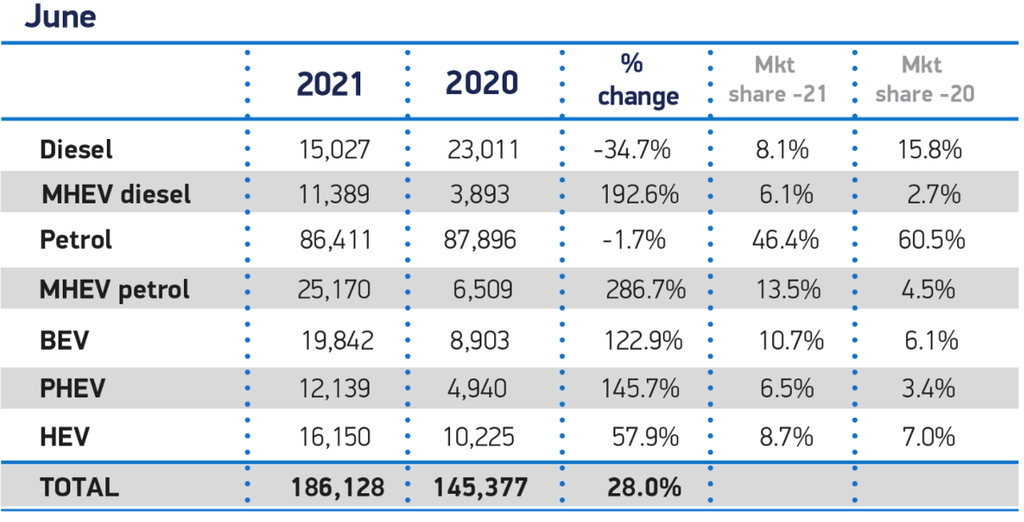

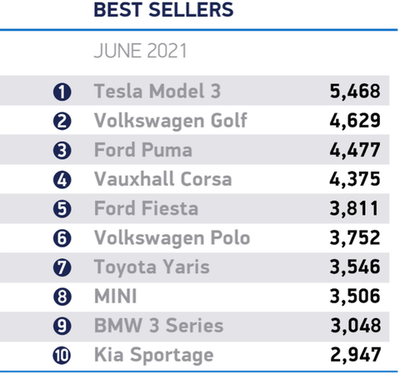

New car registration by vehicle type

Analysis

Mike Hawes, SMMT Chief Executive, said: “With the final phases of the UK’s vaccine rollout well underway and confidence increasing, the automotive sector is now battling against a ‘long Covid’ of vehicle supply challenges.

“The semiconductor shortages arising from Covid-constrained output globally are affecting vehicle production, disrupting supply on certain models and restricting the automotive recovery. However, rebuilding for the next decade is now well underway with investment in local battery production beginning and a raft of new electrified models in showrooms.

“With the end of domestic restrictions later this month looking more likely, business and consumer optimism should improve further, fuelling increased spending, especially as the industry looks towards September and advanced orders for the next plate change.”

Europe Focus (ACEA)

| Jun-21 | Jun-20 | %Change 21/20 | Jan-Jun 2021 | Jan-Jun 2020 | %Change 21/20 | |

| France | 199,508 | 233,814 | -14.7 | 922,765 | 715,798 | +28.9 |

| Germany | 274,152 | 220,272 | +24.5 | 1,390,889 | 1,210,622 | +14.9 |

| Italy | 149,438 | 132,691 | +12.6 | 884,750 | 584,237 | +51.4 |

| Spain | 96,785 | 82,651 | +17.1 | 456,833 | 339,855 | +34.4 |

| United Kingdom | 186,128 | 145,377 | +28.0 | 909,973 | 653,502 | +39.2 |

| Total (EU + EFTA + UK) | 1,161,115 | 1,027,800 | +13.0 | 5,865,045 | 4,594,563 | +27.7 |

Analysis

In June 2021, passenger car registrations in the European Union increased again (+10.4%) compared to the same month last year, albeit at a more modest rate than in previous months. Looking at the major EU car markets, Germany posted the biggest gain with a 24.5% increase, followed by Spain (+17.1%) and Italy (+12.6%). In France, by contrast, passenger car sales contracted (-14.7%) in June.

Over the first half of 2021, EU demand for new cars grew by 25.2% to reach almost 5.4 million units registered in total. However, this is still 1.5 million units below the pre-Covid volume recorded over the first six months of 2019. The region’s 27 markets posted rather similar results so far this year, with strong year-on-year gains seen in most countries, including the four major ones: Italy (+51.4%), Spain (+34.4%), France (+28.9%) and Germany (+14.9%).