INSIGHT

Databank – January 2022

The latest data from around the automotive industry

Motor finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Nov-21 | % change on prev. year | 3 months to Nov 2021 | % change on prev. year | 12 months to Nov 2021 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 1,378 | 37 | 4,833 | -9 | 17,314 | 10 |

| Number of cars | 56,921 | 32 | 204,308 | -12 | 732,249 | 4 |

| Used cars | ||||||

| Value of advances (£m) | 1,748 | 55 | 5,230 | 12 | 19,004 | 18 |

| Number of cars | 113,068 | 33 | 345,659 | -2 | 1,361,281 | 9 |

| Total cars | ||||||

| Value of advances (£m) | 3,126 | 47 | 10,062 | 2 | 36,318 | 14 |

| Number of cars | 169,989 | 33 | 549,967 | -6 | 2,093,530 | 7 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Nov-21 | % change on prev. year | 3 months to Nov 2021 | % change on prev. year | 12 months to Nov 2021 | % change on prev. year |

| New cars | ||||||

| Number of cars | 22,350 | -14 | 74,205 | -10 | 302,961 | 12 |

| Used cars | ||||||

| Number of cars | 4,458 | 4 | 13,592 | -14 | 49,299 | -16 |

Analysis: Geraldine Kilkelly, director of research and chief economist at the FLA

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The strong growth reported by the consumer car finance market in November reflects low new business volumes reported a year earlier as the UK entered another lockdown to deal with rising cases of Covid-19.

“The market’s recovery continues to be disrupted by supply side shortages and the increasing squeeze on household disposable incomes from higher inflation and interest rates. New business volumes in the consumer car finance market are likely to be just over 2.1 million cars in 2021 as a whole, 12% lower than at the onset of the pandemic in February 2020.”

Motor industry statistics (SMMT)

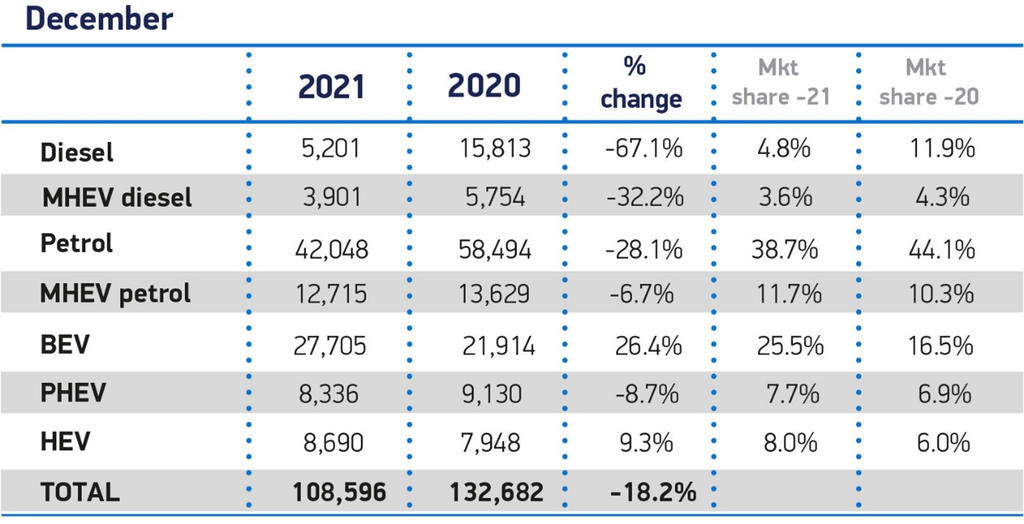

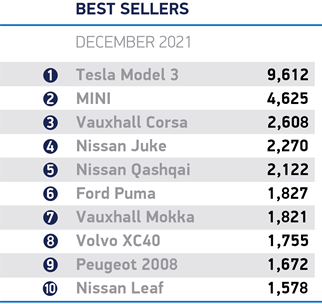

New car registration by vehicle type

Analysis: Mike Hawes, chief executive at the SMMT

Mike Hawes, SMMT chief executive, said, “It’s been another desperately disappointing year for the car industry as Covid continues to cast a pall over any recovery. Manufacturers continue to battle myriad challenges, with tougher trading arrangements, accelerating technology shifts and, above all, the global semiconductor shortage which is decimating supply.

“Despite the challenges, the undeniable bright spot is the growth in electric car uptake. A record-breaking year for the cleanest, greenest vehicles is testament to the investment made by the industry over the past decade and the inherent attractiveness of the technology. The models are there, with two of every five new car models now able to be plugged in, drivers have the widest choice ever and the industry is working hard to overcome Covid-related supply constraints.”

Europe focus (ACEA)

| Dec-21 | Dec-20 | %Change 21/20 | Jan-Dec 2021 | Jan-Dec 2020 | %Change 21/20 | |

| France | 158,117 | 186,323 | -15.1 | 1,659,003 | 1,650,118 | +0.5 |

| Germany | 227,630 | 311,394 | -26.9 | 2,622,132 | 2,917,678 | -10.1 |

| Italy | 86,679 | 119,620 | -27.5 | 1,457,952 | 1,381,756 | +5.5 |

| Spain | 86,081 | 105,840 | -18.7 | 859,477 | 851,210 | +1.0 |

| United Kingdom | 108,596 | 132,682 | -18.2 | 1,647,181 | 1,631,064 | +1.0 |

| Total (EU + EFTA + UK) | 950,218 | 1,214,062 | -21.7 | 11,774,885 | 11,958,116 | -1.5 |

Analysis

In December 2021, passenger car registrations across the European Union declined by 22.8% to 795,295 units, marking the sixth consecutive month of decline. Most of the region’s markets faced double-digit drops, including the four major ones: Italy (-27.5%), Germany (-26.9%), Spain (-18.7%) and France (-15.1%). In fact, the only EU car markets that expanded last month were Bulgaria, Croatia, Latvia and Slovenia.

Overall in 2021, sales of new cars in the EU fell by 2.4% to 9.7 million units, despite the record low base of comparison of 2020. This fall was the result of the semiconductor shortage that negatively impacted car production throughout the year, but especially during the second half of 2021.