INSIGHT

Databank – February 2021

The latest data from around the automotive industry

Motor Finance statistics (FLA)

| Table 1: Cars bought on finance by consumers through the point of sale | ||||||

| New business | Dec-20 | % change on prev. year | 3 months to Dec 2020 | % change on prev. year | 12 months to Dec 2020 | % change on prev. year |

| New cars | ||||||

| Value of advances (£m) | 1,104 | -16 | 3,531 | -14 | 15,496 | -21 |

| Number of cars | 45,815 | -18 | 152,951 | -17 | 696,737 | -25 |

| Used cars | ||||||

| Value of advances (£m) | 1,127 | -5 | 3,873 | -7 | 16,116 | -13 |

| Number of cars | 84,193 | -8 | 293,474 | -12 | 1,237,859 | -18 |

| Table 2: Cars bought on finance by businesses | ||||||

| New business | Dec-20 | % change on prev. year | 3 months to Dec 2020 | % change on prev. year | 12 months to Dec 2020 | % change on prev. year |

| New cars | ||||||

| Number of cars | 25,079 | -20 | 78,877 | -19 | 264,052 | -39 |

| Used cars | ||||||

| Number of cars | 4,139 | 38 | 14,799 | 34 | 60,108 | 9 |

Analysis

Geraldine Kilkelly, head of research and chief economist at the FLA, said: “The lifting of the second national lockdown in England in December contributed to an easing in the rate of contraction in new business in both the consumer new and used car finance market. Despite the restrictions introduced throughout last year as a result of the pandemic, the consumer car finance market provided finance for over 1.9 million cars in 2020 as a whole.

“The vaccine rollout in the UK has improved the outlook for the UK economy in the second half of 2021. Almost two-thirds of motor finance respondents to the FLA’s Q1 2021 Industry Outlook Survey expected some growth in new business over the next year if economic conditions improve.”

Motor Industry statistics (SMMT)

Analysis

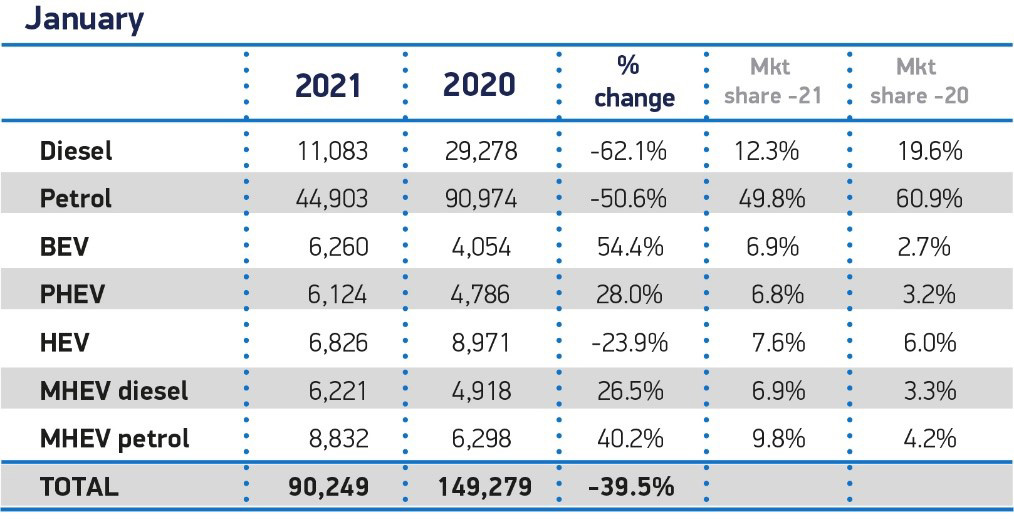

Mike Hawes, SMMT chief executive, said: “Following a £20.4 billion loss of revenue last year, the auto industry faces a difficult start to 2021. The necessary lockdown will challenge society, the economy and our industry’s ability to move quickly towards our ambitious environmental goals.

“Lifting the shutters will secure jobs, stimulate the essential demand that supports our manufacturing, and will enable us to forge ahead on the Road to Zero. Every day that showrooms can safely open will matter, especially with the critical month of March looming.”

Europe Focus (ACEA)

| Jan-21 | Jan-20 | %Change | Jan-Jan 2021 | Jan-Jan 2020 | %Change | |

| France | 126,380 | 134,229 | -5.8 | 126,380 | 134,229 | -5.8 |

| Germany | 169,754 | 246,300 | -31.1 | 169,754 | 246,300 | -31.1 |

| Italy | 134,001 | 155,867 | -14 | 134,001 | 155,867 | -14 |

| Spain | 41,966 | 86,442 | -51.5 | 41,966 | 86,442 | -51.5 |

| United Kingdom | 90,249 | 149,279 | -39.5 | 90,249 | 149,279 | -39.5 |

| Total (EU + EFTA + UK) | 842,835 | 1,134,898 | -25.7 | 842,835 | 1,134,898 | -25.7 |

Analysis

Nearly all 27 EU markets suffered double-digit losses last month, including three of the four major ones: Spain was the hardest-hit (-51.5%), followed by Germany (-31.1%) and Italy (-14.0%). With a slight drop of 5.8%, France was the best performing major market. In fact, Sweden (+22.5%) and France were the only EU countries that did not post double-digit drops in January.